Introduction

This memo was supposed to be a simple summary of the reasons behind our biggest investment in 2023 — a $23.2M round into Transmutex, a nuclear infrastructure company. We co-led this round with Albert Wenger from Union Square Ventures with significant participation from At One Ventures (led by Helen Lin) among other exceptional investors.

As we reflected on the source of our conviction, we realized that underlying our investment was more than a singular thesis, but a broader (latent) framework for identifying the biggest opportunities in venture. We felt this framework, that we call The Triad, was worth exploring, formalizing, and sharing. It builds on the thinking and tradition of Investor Philosophers like Albert Wenger (his book The World After Capital is must a read in this domain), Marc Andreessen, Peter Thiel, George Soros and more. Each has developed their own philosophically grounded frameworks for deploying capital and resources to shape the world.

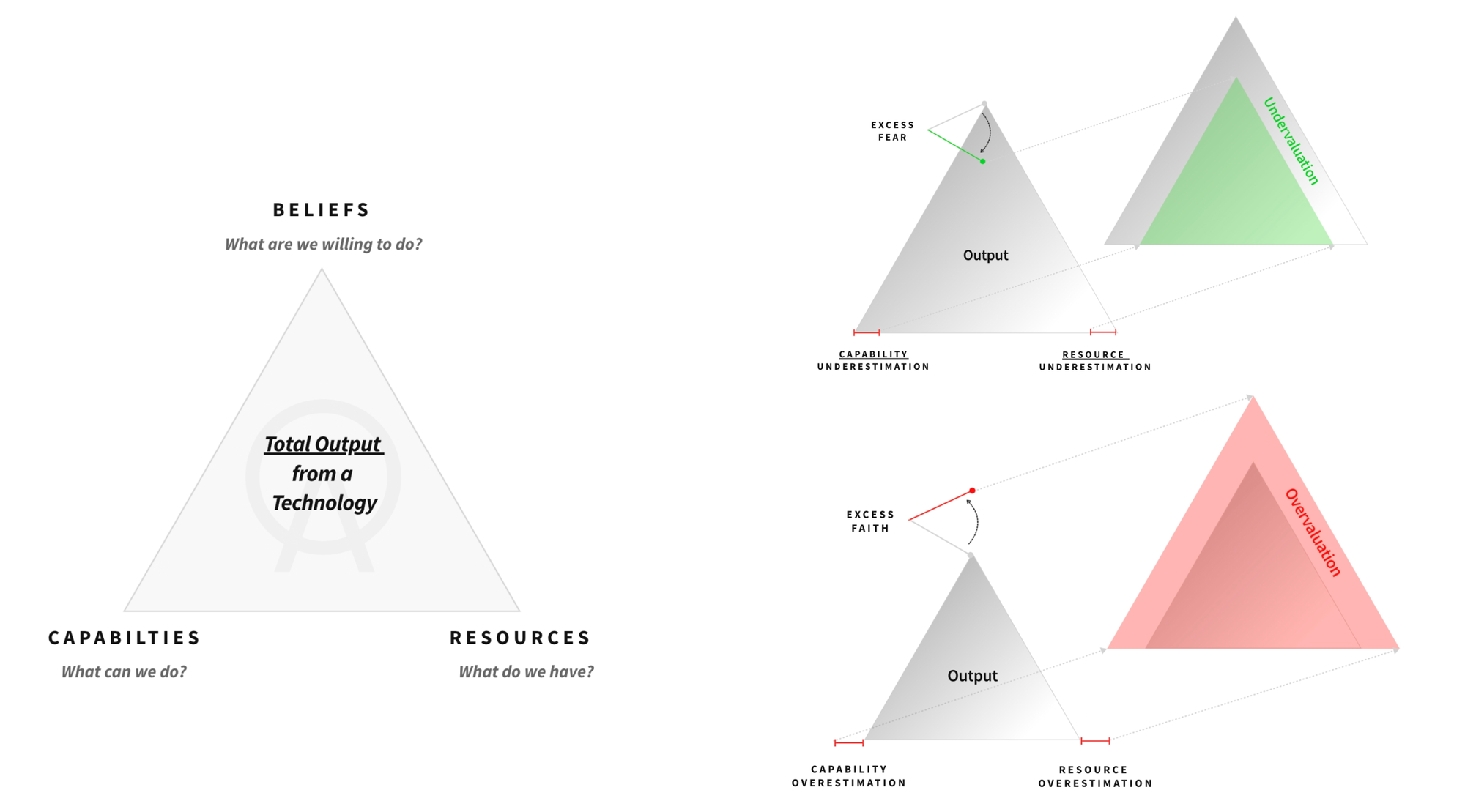

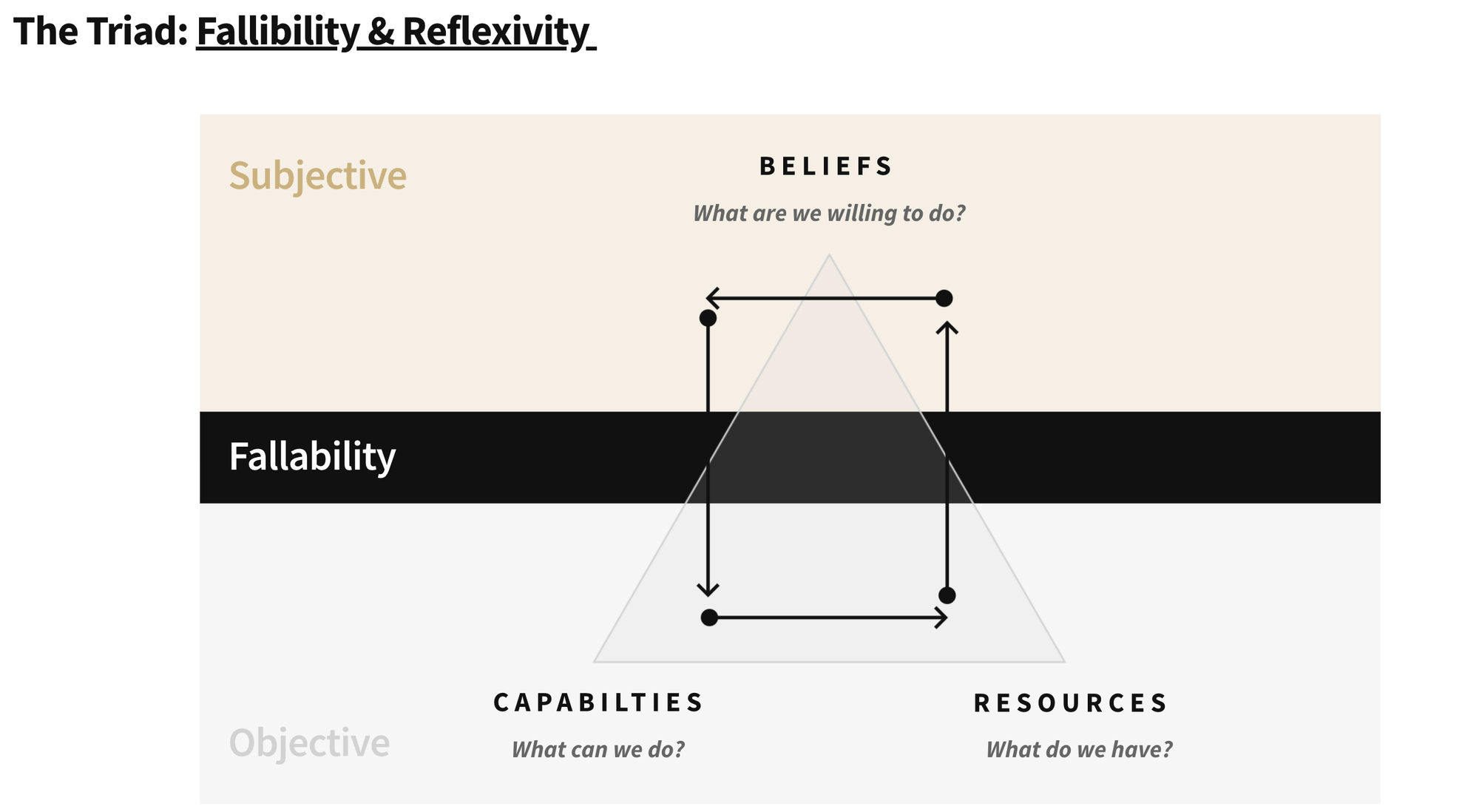

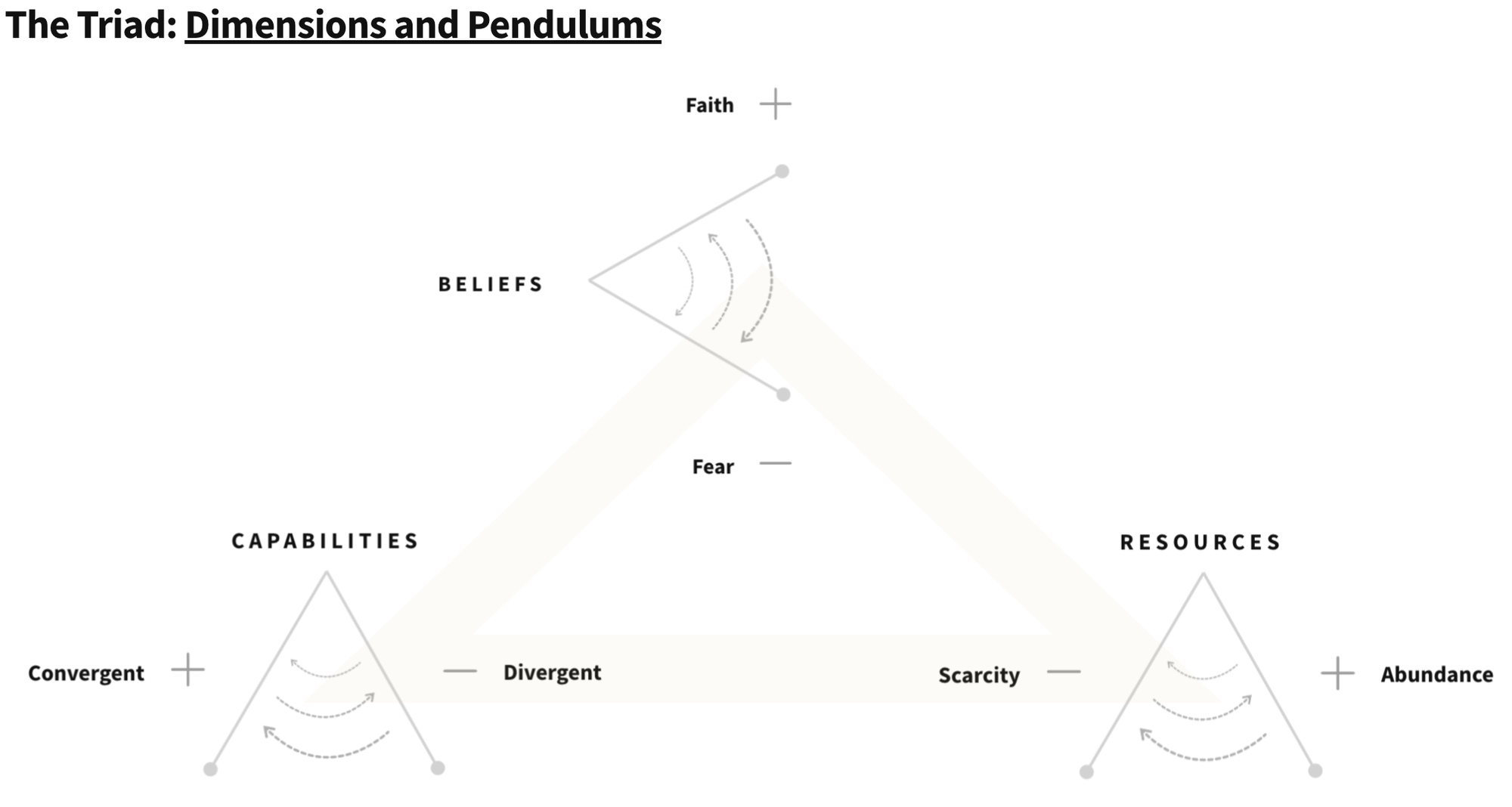

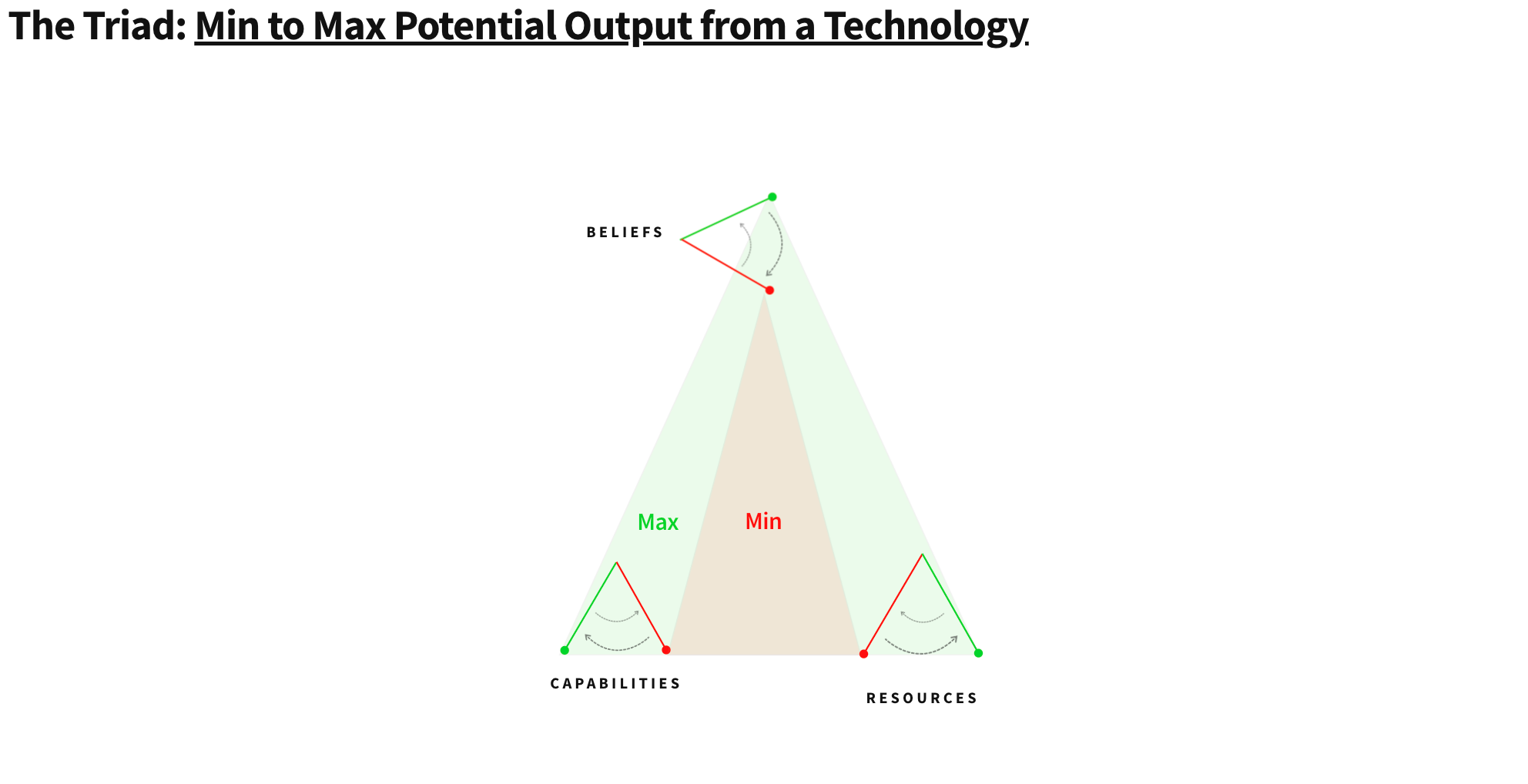

At a high level, The Triad isolates three dimensions that determine the total output from a given technology; our beliefs about the technology, the technology’s actual capabilities, and the resources required (natural, capital, or human) for operation.

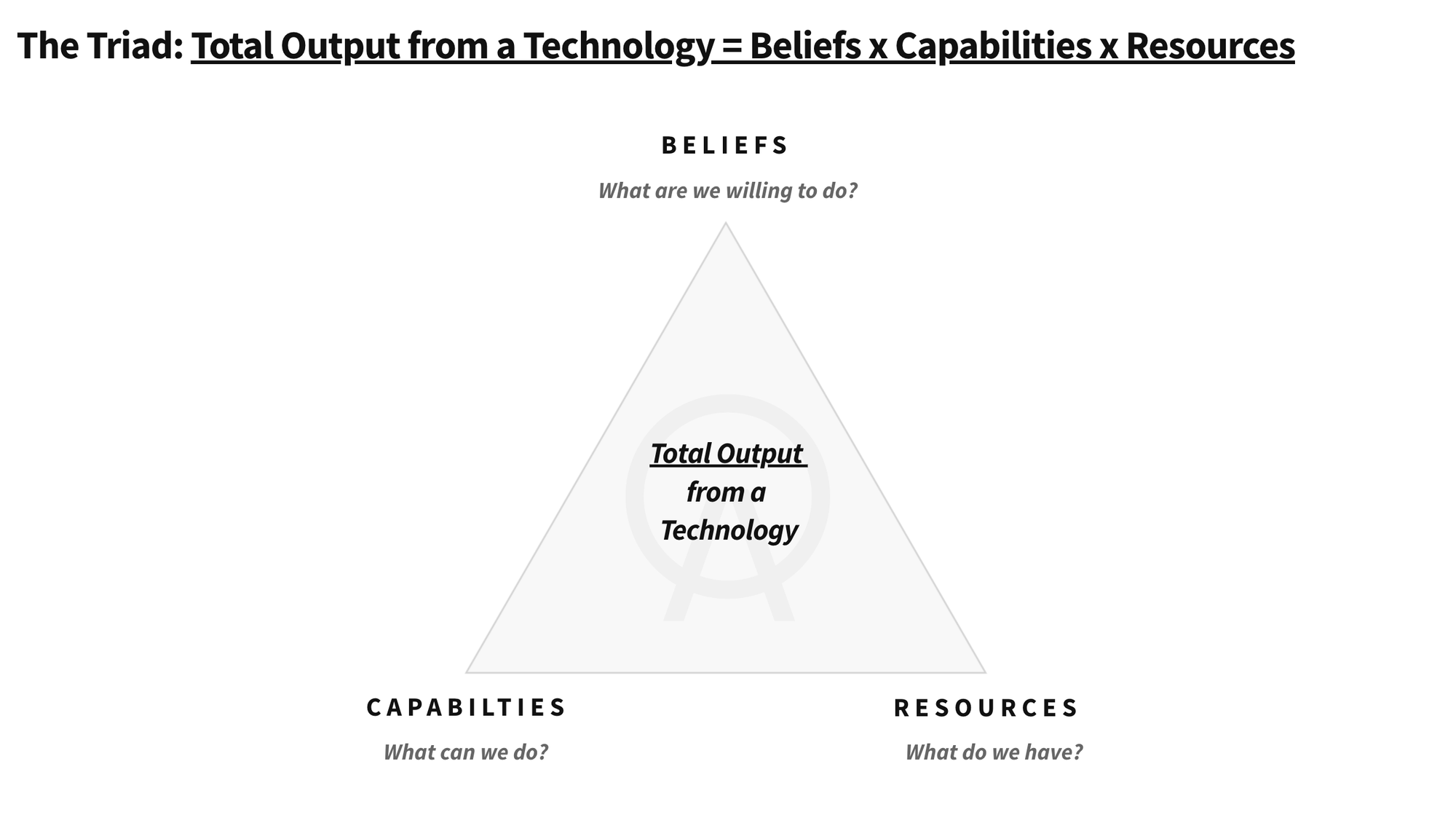

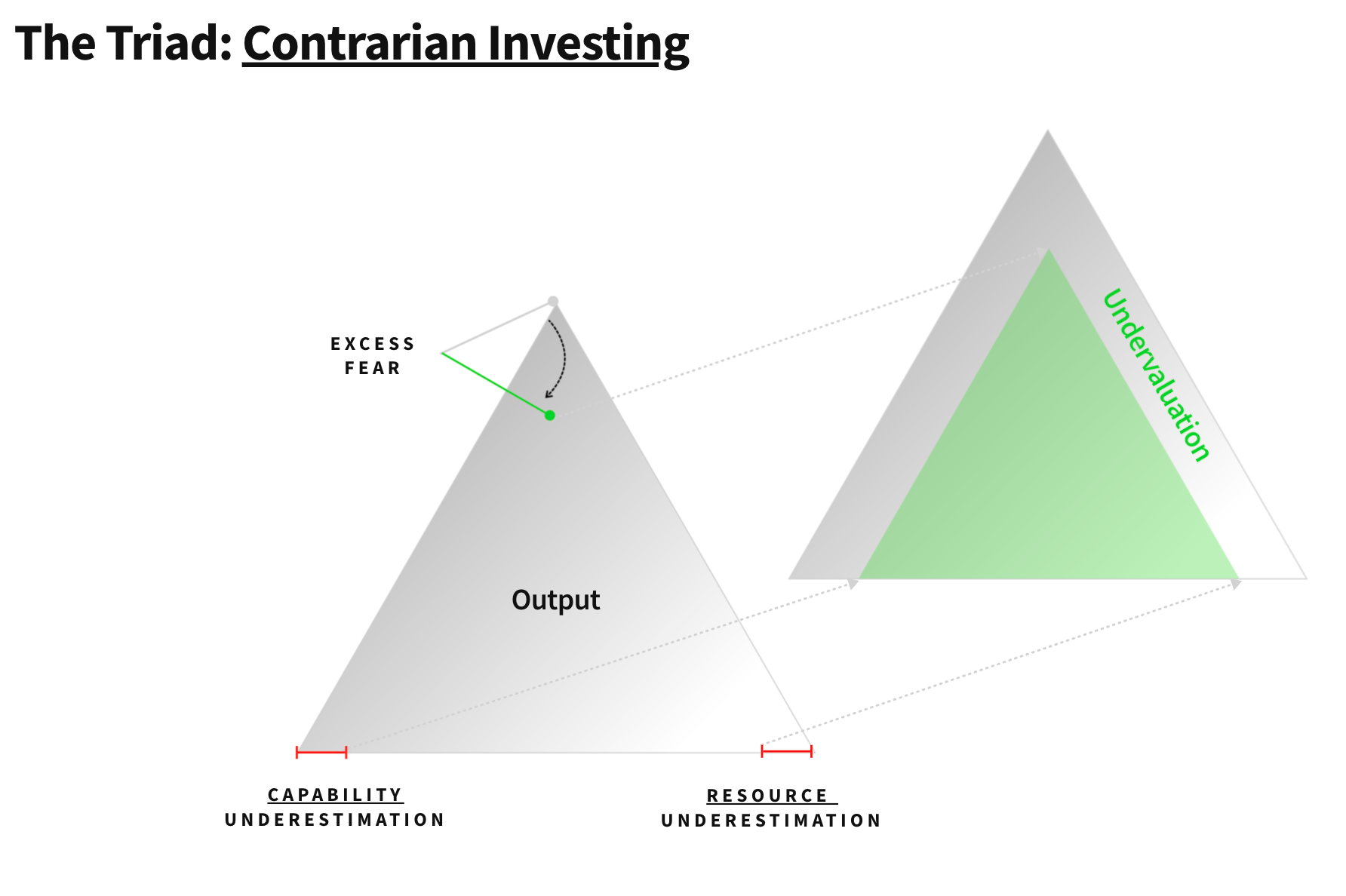

Using The Triad, we can more formally assess why a technology is undervalued by market participants. From this process, we identify several green flags that designate when an investor should deploy venture capital to support the large-scale commercialization of a technology.

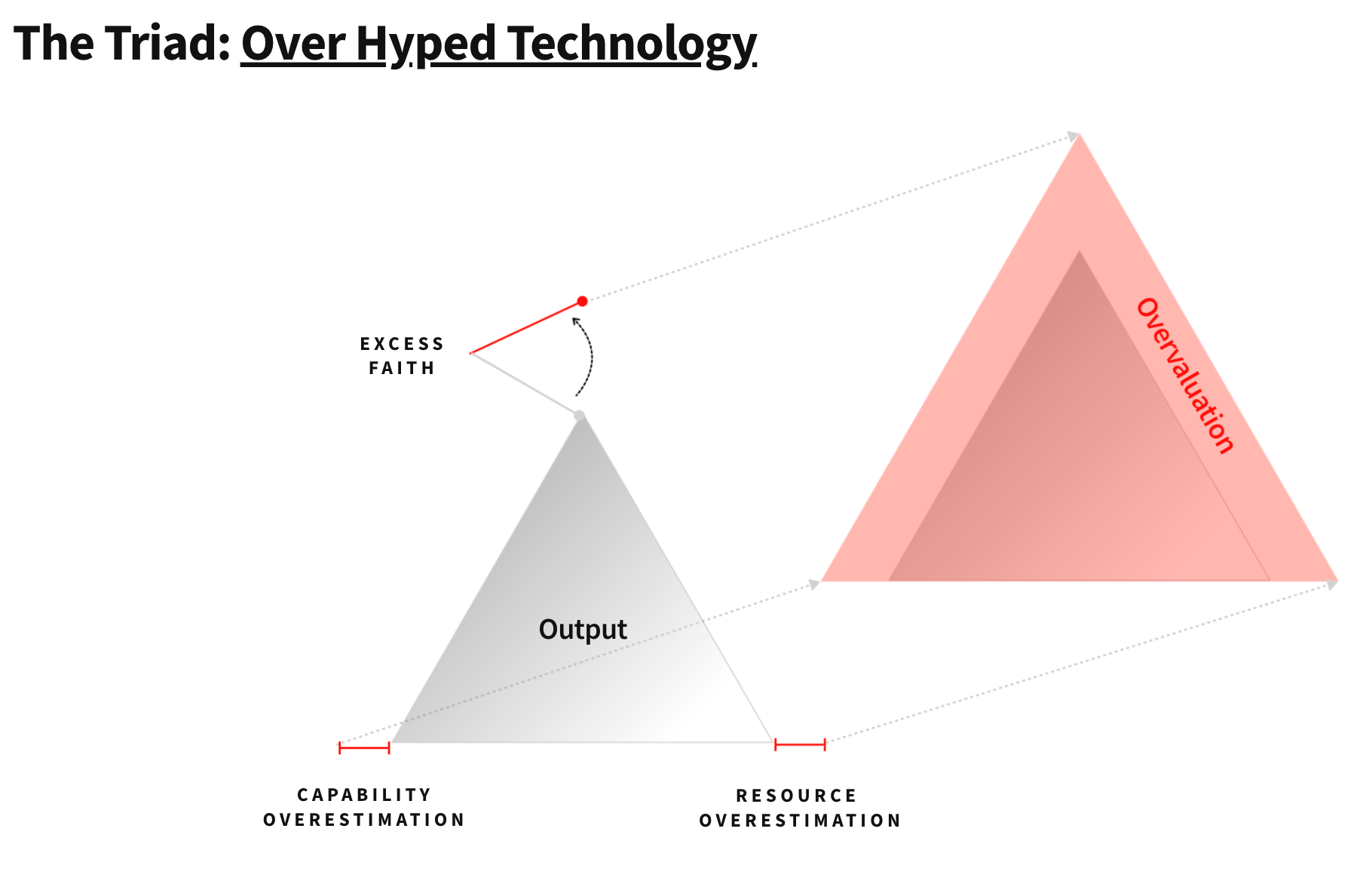

Conversely, The Triad can also be used to assess why a technology is overvalued, leading to red flags that signal when an investor should exercise caution.

Now that you know where we are going, let’s walk through how to get there. If you want to dive deeper, please reach out, as we have a 3x longer version that delves into the philosophy behind the framework and more case studies on its application.

The Investor Philosopher

The Billion Dollar Bet on Reflexivity & Fallibility

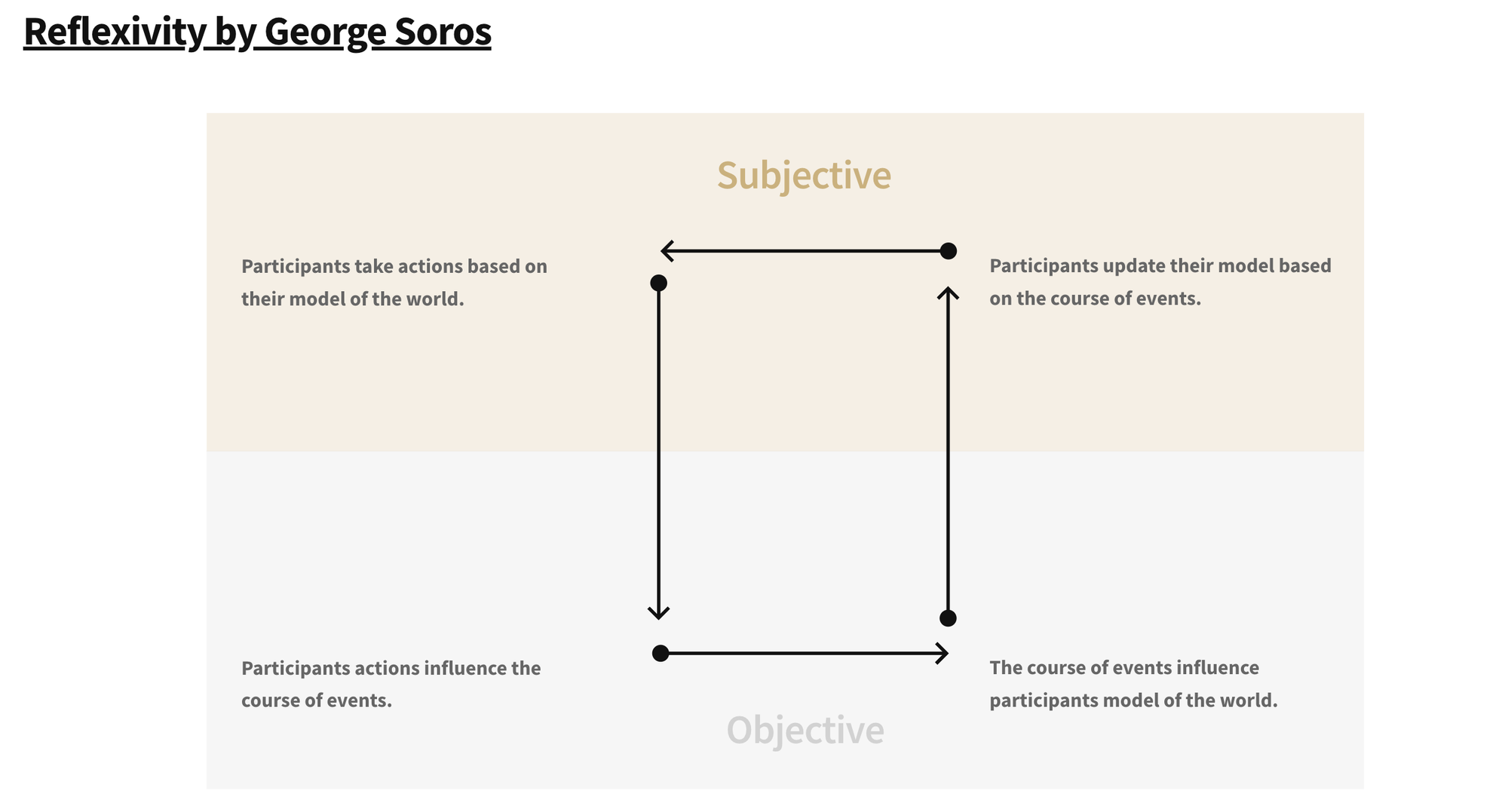

In 1992, George Soros made over £1B in profit in a single day, “breaking the Bank of England” by betting against the British Pound. He believed the pound was overvalued, and the UK would be unable to maintain the peg. He began short-selling the pound based on his framework of reflexivity — “[market] participants’ views influence the course of events, and the course of events influences the participants’ views” creating a positive feedback loop (2009, Soros).

Soros’ framework of reflexivity predicted that the expression of his belief about the true value of the pound would lower others' valuation, leading to more short-selling until collapse. He was right. In total, the UK Treasury spent over £3B failing to defend its position. Soros would credit this and his continued success to philosophy and his framework.

“In the course of my life, I have developed a conceptual framework which has helped me both to make money as a hedge fund manager and to spend money as a policy oriented philanthropist. But the framework itself is not about money, it is about the relationship between thinking and reality, a subject that has been extensively studied by philosophers from early on.” (2009, Soros)

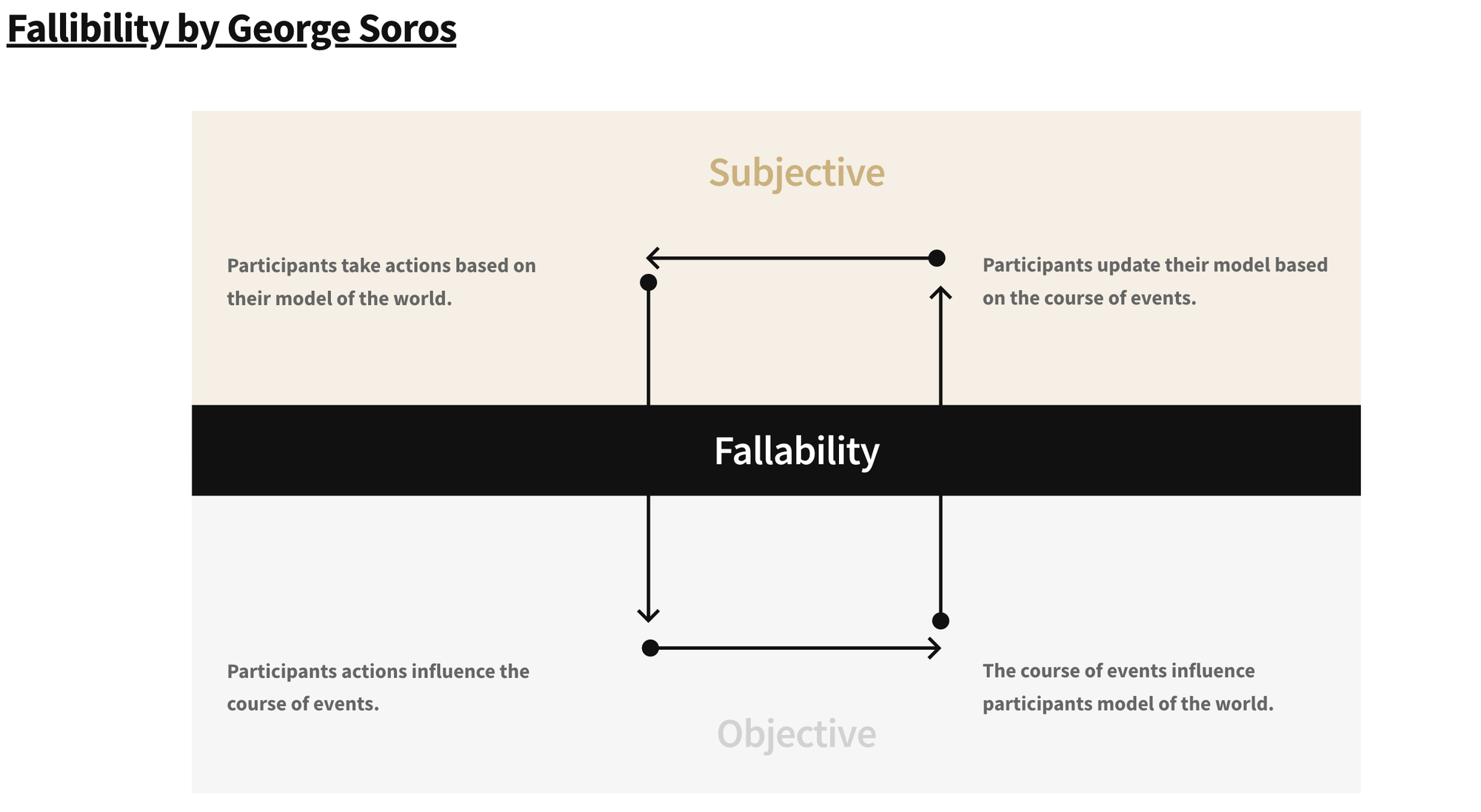

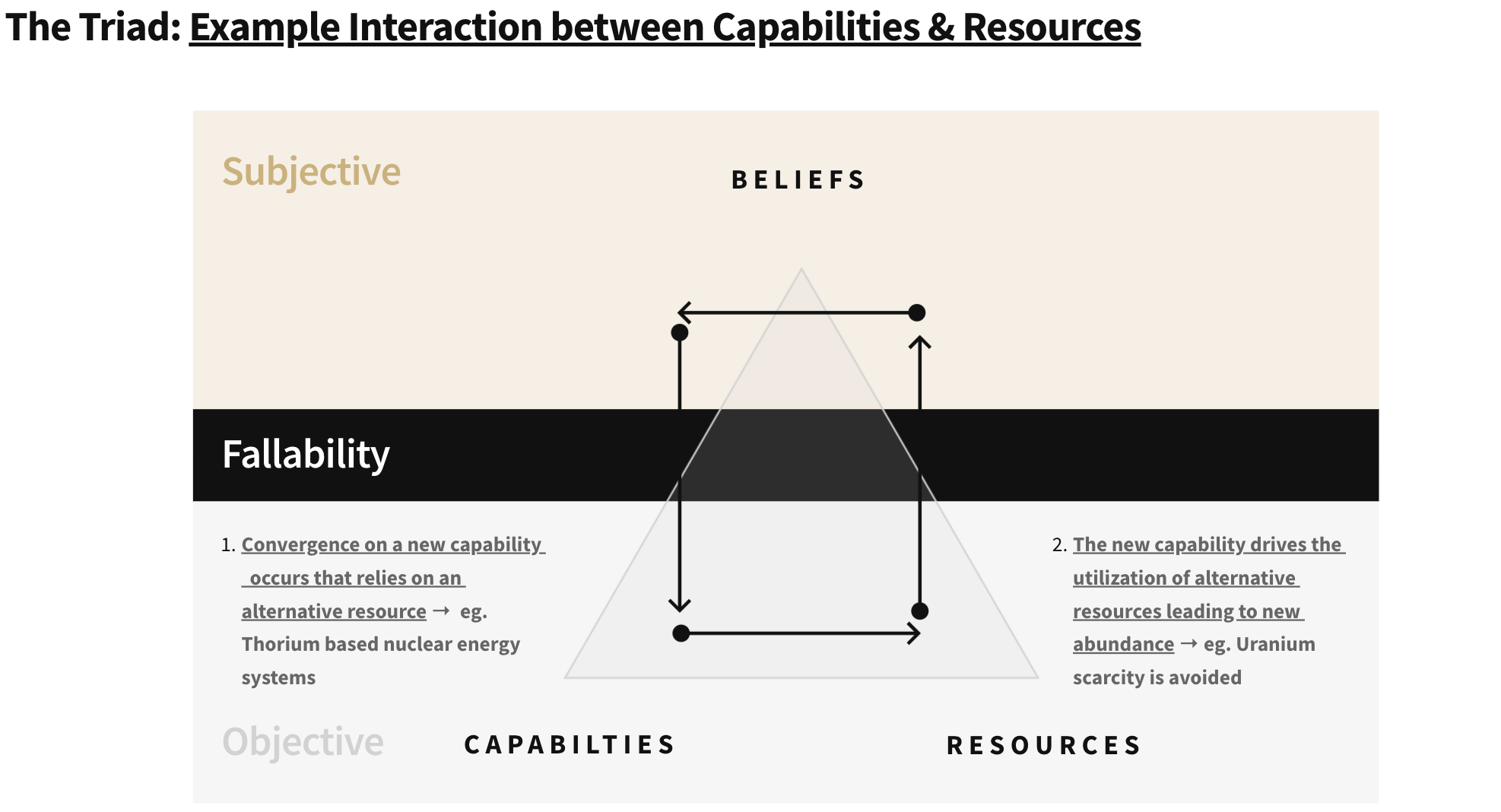

Soros believes opportunities like this one emerge because of our fallibility — that “the complexity of the world in which we live exceeds our capacity to comprehend it” (2009, Soros). This means that there is always a delta between what we believe (the subjective) and reality (the objective) and that it is in the largest of these deltas that the best investment opportunities exist.

With The Triad, we will show that there is an underlying pattern to the emergence of these fallibilities (and thus investment opportunities) in relation to technological adoption. This pattern arises from the reflexive interaction between our beliefs and the capabilities + resources we have access to.

We believe now is an exceptional time to be actively investing as a venture capitalist because opportunities arising from fallibility are increasing. This is due to the heightening complexity of our world (2011, Thiel) and the scarcity of attention dedicated to understanding it (2021, Wenger).

a16z, Founders Fund & Mimesis

Soros is far from alone in his pursuit of philosophy as a foundation for investing. Marc Andreessen, founder of Netscape and a16z, has turned the front page of his firm’s website into an essay titled the “The Techno-Optimist Manifesto”. This philosophical document lists its patron saints including; Bertrand Russell (Logical Positivism), Friedrich Nietzsche (Existentialism, Nihilism), and Nick Land (Accelerationism) among many other philosophers (2023, Andreessen).

Peter Thiel, founder of PayPal, Palantir, and Founders Fund, credits French philosopher René Girard’s theory of mimesis — that all our cultural behaviors are imitative — with giving him the conviction to be the first outside investor in Facebook (1978, Girard). Thiel asserted Facebooks growth can be attributed to its “doubly mimetic” nature in that the platform is “spread by word of mouth, and it’s about word of mouth” (2019, Perell).

Mimesis drives us first to compete for the same objects (or investments) because we learn to want the same things. As that object-oriented competition persists, we transcend the object and begin competing with one another directly in what is known as mimetic rivalry. Our desire is no longer just about getting something, but about being better than the other (2019, Bi).

In the world of venture capital, mimetic rivalry is one of the mechanisms that can drive irrational investments. Venture funds first compete for the same deals and then begin to compete directly with each other with disregard for the fundamentals of an investment (the object). This leads to fallibility as funds begin pursuing or avoiding technologies based on the perceived interests of others instead of their assessment of technological capabilities and required resources. Investing without succumbing to these mimetic forces is at the foundation of being what Founders Fund calls “contrarian” (2017, Gibney). In the sections to come, we will show that The Triad can help us structure the pursuit of being contrarian and right.

The Triad

The purpose of The Triad is to provide a framework for understanding the potential of large-scale technological adoption. This is achieved by isolating three interacting dimensions that determine the “shape” of adoption for a given technology. These dimensions are:

- Capabilities → what we can do.

- e.g., we can build nuclear fission systems that produce low-cost, carbon-free energy.

- e.g., we can build nuclear fission systems that produce low-cost, carbon-free energy.

- Resources → what we have.

- e.g., we have Uranium or Thorium to fuel those systems and engineers capable of operating them.

- e.g., we have Uranium or Thorium to fuel those systems and engineers capable of operating them.

- Beliefs → what are we willing to do.

- e.g., we have been unwilling to build nuclear power plants for sociopolitical reasons.

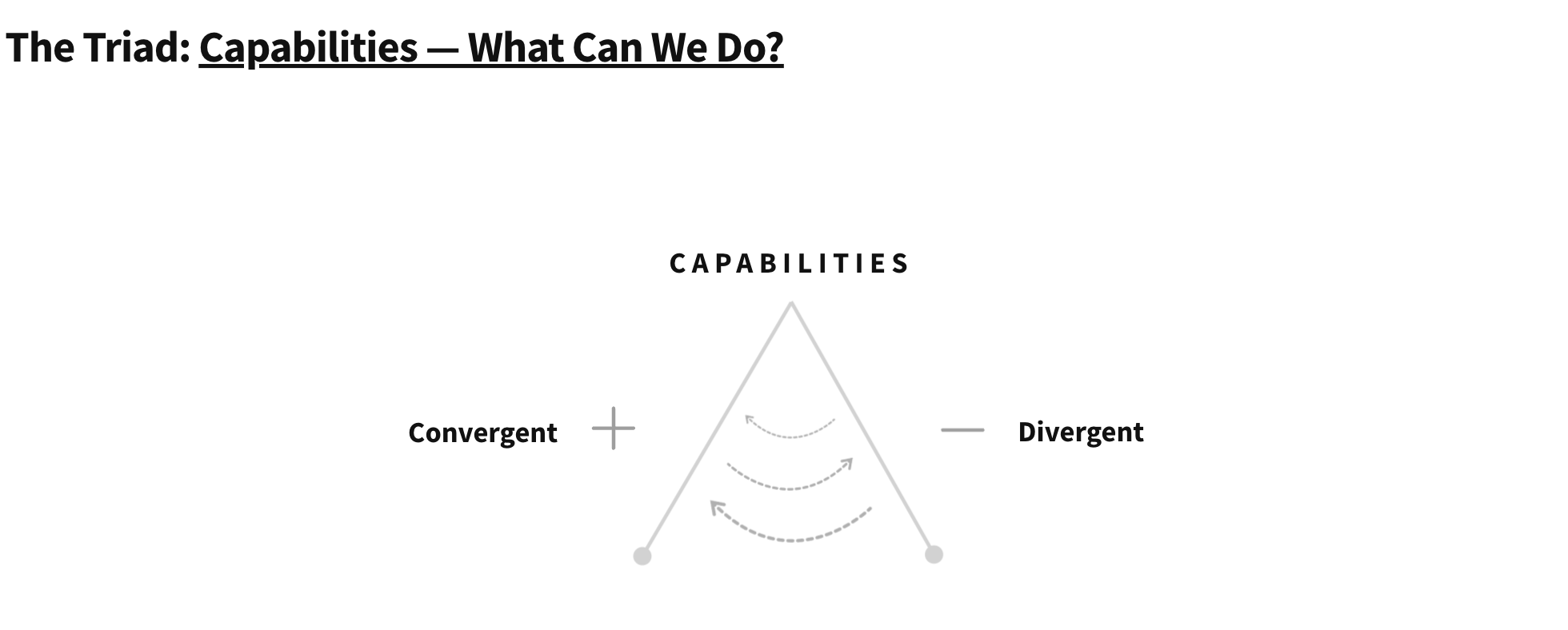

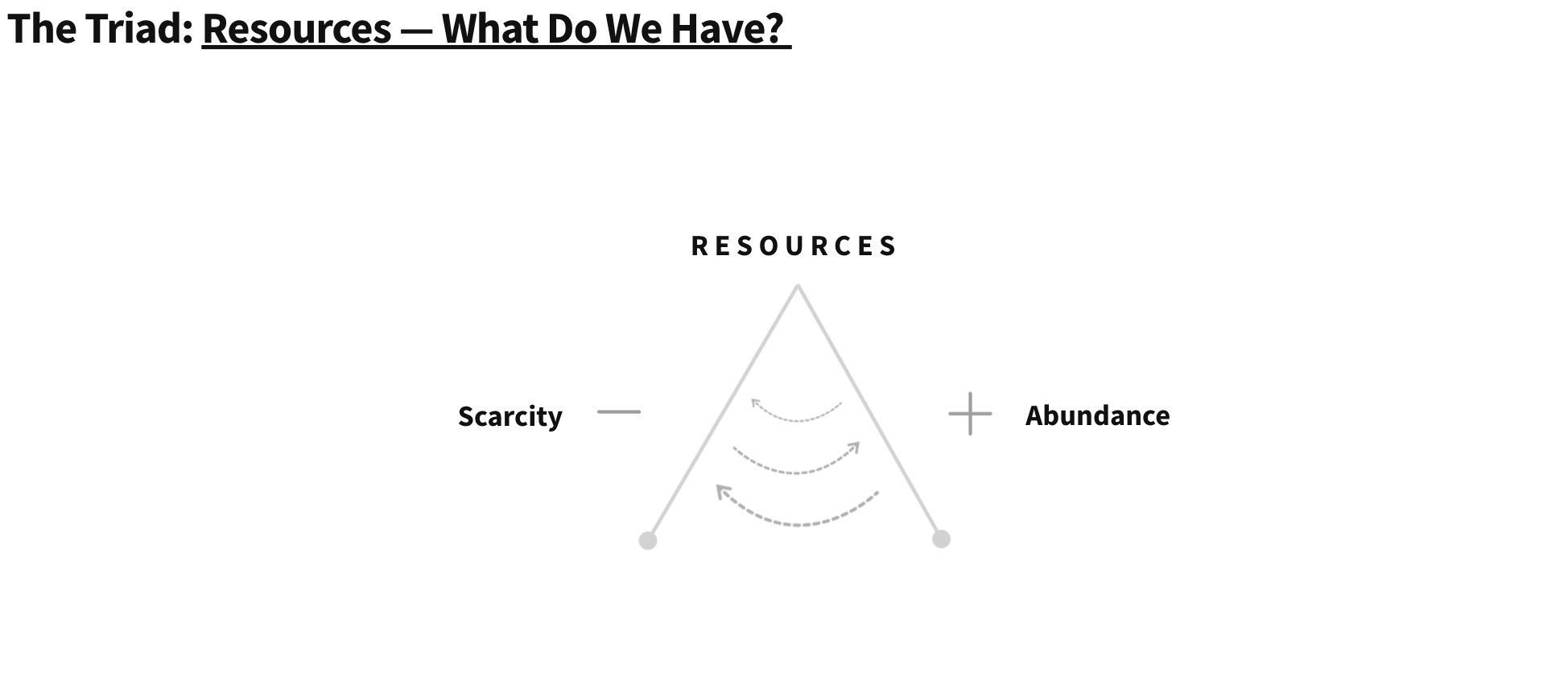

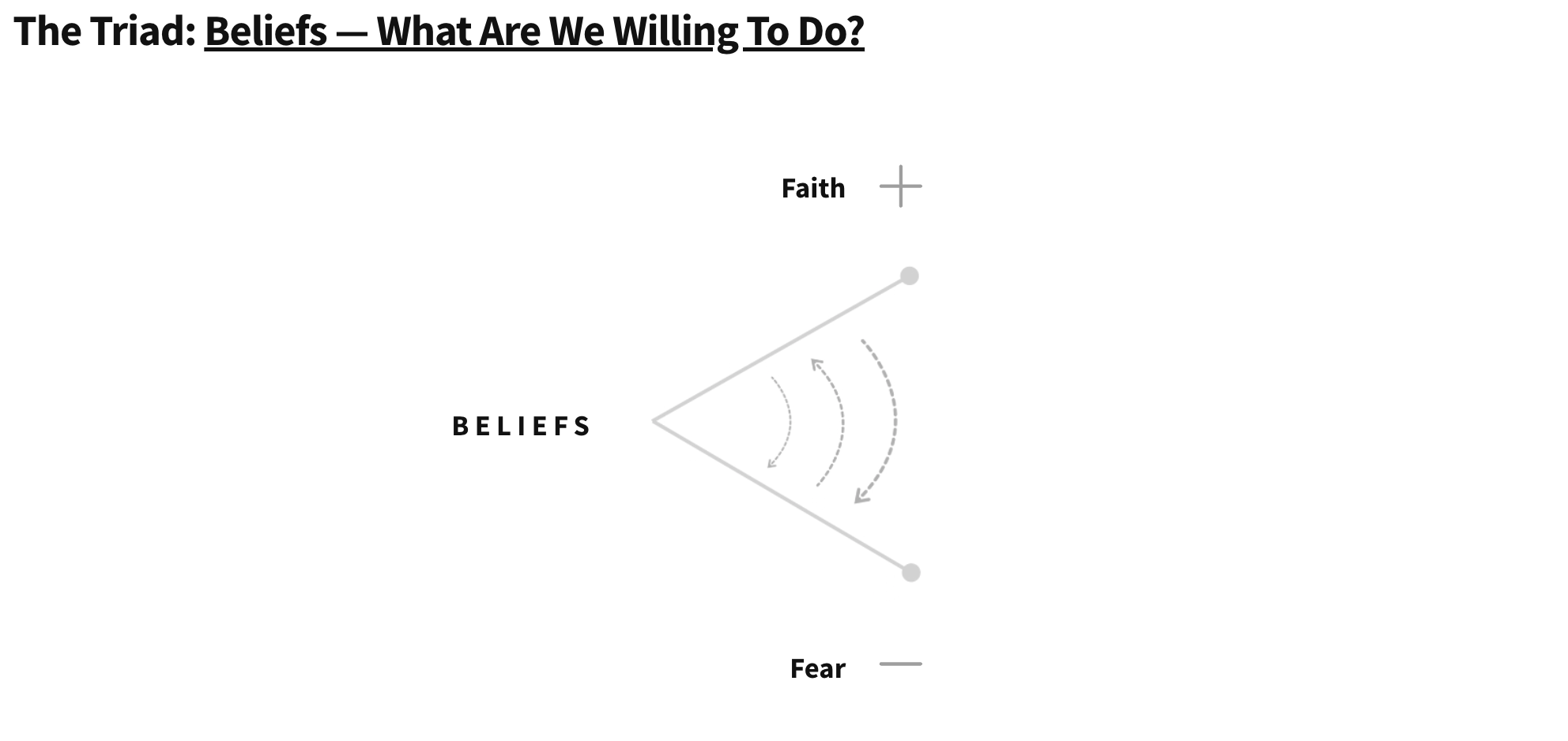

Each of these dimensions operates along a spectrum with a positive and negative polarity. Like a pendulum, the state of the dimensions is constantly swinging back and forth between the poles.

Capabilities Spectrum = [Divergent, Convergent]

- Divergent → a state where experts are exploring many paths to producing a given solution or capacity

- Convergent → a state where experts have identified and moved towards a single dominant path for producing a given solution or capacity

Resources Spectrum = [Scarce, Abundant]

- Scarce → a state where a given resource is difficult to access (often corresponding to relatively high prices).

- Abundant → a state where a given resource is easy to access (often corresponding to relatively low prices).

Beliefs Spectrum = [Fearful, Faithful]

- Fearful → a state where participants are unwilling to act despite evidence.

- Faithful → a state where participants are willing to act despite evidence.

With these pendulums in mind, we can begin to see why there is a predictable pattern to the emergence of what Soros calls fertile fallibilities (2009, Soros). Oscillations in our pursuit of capabilities (divergence / convergence) and ability to access resources (scarcity / abundance) drive participants (through irrational mechanisms like mimesis) to hold beliefs that are iteratively fearful or faithful in excess.

The Dimensions Detailed

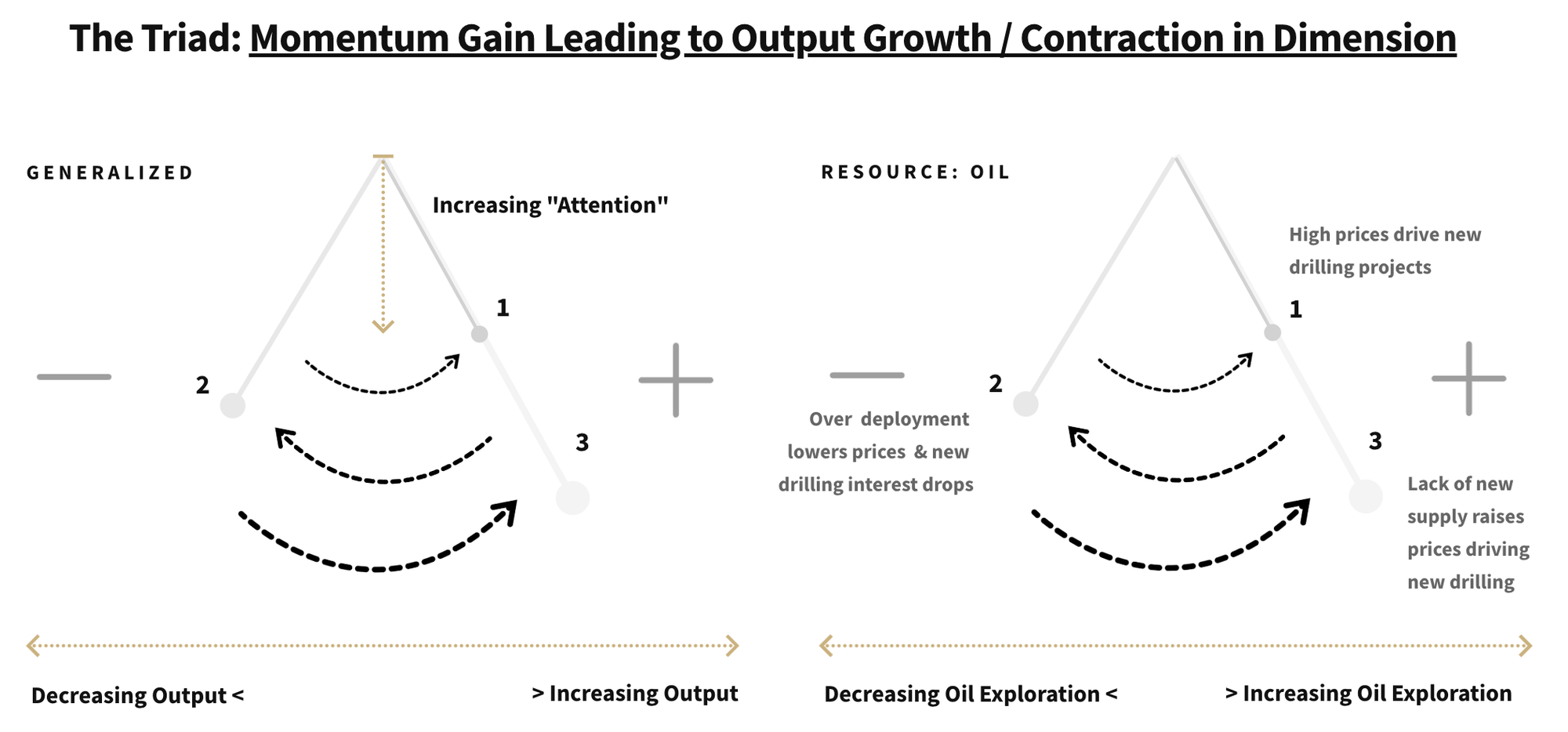

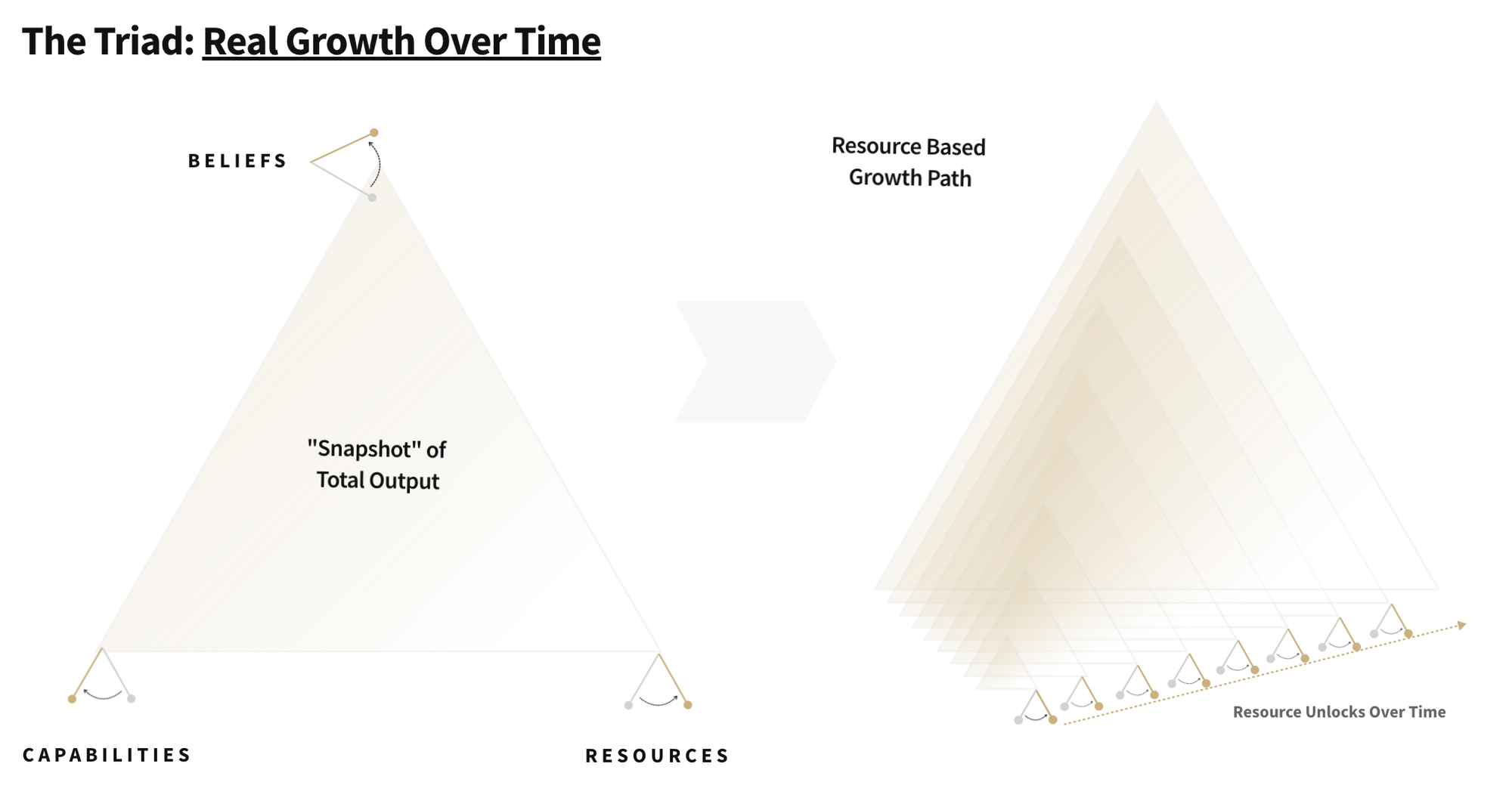

Each of the dimensions (beliefs, capabilities, and resources) has the capacity to contribute to growth in the output from a technology. This occurs via iteratively larger swings of the “pendulums” (from excess fear to faith via social movements or resources scarcity to abundance through mining exploration). Over time, these pendulums gain momentum due to increased attention from market participants.

As attention increases, the pendulums oscillate through ever larger cycles of growth and contraction. To understand this growth and contraction, we can treat the triangular area created by the dimensions as an abstracted measure of total potential output from a particular technology. The size of our output for a given technology is (objectively) a function of our capabilities and access to resources powering those capabilities as well as our (subjective) beliefs, which are only partially determined by the objective dimensions. With that, we can visualize an idealized growth path along a single dimension by showing only the “positive” pendulum swings over time, as seen below:

The adoption of a technology and the attributable output from it is never just “up and to the right”. Among the many potential reasons, contractions can occur due to emergent resource scarcity, unforeseen externalities from a capability (pollution) that require developing new capabilities, or a shift from faith in a technology to fear due to media biases. These factors work with one another to create the tech cycles that we are familiar with (2003, Perez). Let’s now dive into examples of each of these dimensions to make this concrete.

Capabilities → What can we do?

The purpose of technology is to create new capabilities. These capabilities are developed to solve a problem from zero-carbon base-load energy to efficient mineral separation. The pursuit of new capabilities can be divided into two phases, divergent (exploration of what works) and convergent (refinement / iterations on known solution) as shown below:

We can see these convergent and divergent phases across capability types (from software standards to phone and car design).

Phases of Artificial Intelligence Capabilities

- First Divergent Phase (1950s - late 1970s): Beginning with the conceptualization of AI and early explorations, this period includes the initial excitement around AI, the development of the first neural networks, and early AI programs.

- First Convergent Phase (late 1970s - late 1990s): Focusing on practical applications and the rise of expert systems, this period saw AI being applied in more specific domains. The limitations of early neural networks led to a focus on rule-based systems and classical machine learning techniques.

- Second Divergent Phase (late 1990s - early 2010s): Marked by the resurgence of neural networks and the advent of big data, this phase witnessed the birth of deep learning and its application in various fields. There was also significant growth in AI subfields like natural language processing, computer vision, and reinforcement learning.

- Second Convergent Phase (early 2010s - present): Characterized by the refinement of deep learning techniques and the emergence of large-scale AI models like GPT (Generative Pre-trained Transformer) and LLMs (Large Language Models). The focus has been on making AI more efficient, ethical, and accessible across applications.

Resources → What do we have?

To implement or utilize capabilities requires resources. These can be natural resources (oil / uranium) as well as physical capital (manufacturing facilities) or human capital (engineers).

The development of new capabilities (alternative battery chemistries) drive demand away from scarce resources (lithium) to new resources abundant ones (potassium). Similarly, if new resources are discovered (accessible vanadium deposits), new capabilities can become viable (vanadium redox flow batteries).

Resources move from phases of abundance to scarcity as large-scale adoption of consuming technologies occurs, and vice versa as capabilities unlock alternatives. During periods of scarcity, prices are high, driving investment (exploration for deposits or training of talent). During periods of abundance, prices drop, contracting investment. We see this dynamic at work across sectors.

Phases of Oil Resources

- First Abundance Phase (1850s - 1910s): Oil was relatively abundant due to the discovery of large reserves and the lack of widespread industrial demand, making it relatively cheap and accessible.

- First Scarcity Phase (1970s - 1980s): Political and socio-economic factors, including the OPEC oil embargo, led to a realization of the geopolitical vulnerability of oil supplies, causing prices to soar and highlighting the scarcity of easily accessible oil.

- Second Abundance Phase (1990s - 2000s): Advances in exploration and extraction technologies, such as offshore drilling and improved seismic imaging, led to the discovery of new oil fields and the exploitation of previously inaccessible reserves. This period saw a relative abundance of oil, leading to lower prices.

- Second Scarcity Phase (2010s - present): This phase is marked not so much by the physical scarcity of oil but by a shift in global energy priorities towards renewable resources due to climate change concerns, and the realization of the finite nature of fossil fuels. This has led to increased investment in alternative energy sources and a gradual move away from oil dependence.

Beliefs → What are we willing to do?

Just because we can do something does not mean we will. Unfortunately, nuclear energy is the perfect example of this. We could have clean, reliable base-load power. But we don’t. This is because of our fallibility (the delta between the objective and subjective) that leads us to having excessive fear (or faith) in a particular technology. We have been too afraid to deploy nuclear energy systems at scale, despite evidence of their effectiveness (see French nuclear).

Due to our fallibility, we oscillate between phases of excess fear or faith in technologies based on rational assessments of capabilities and access to resources, as well as irrational reflexive loops and mimeses. In periods of faith, we are willing to adopt and invest in technologies despite a lack of evidence of its effectiveness. In periods of fear, we are unwilling to adopt and invest in technology despite evidence of its effectiveness.

The swings of this pendulum manifest as social movements that are self-fulfilling (reflexive). Belief that a technology is not effective (or dangerous) leads to us underinvesting in that technology and it being ineffective. Conversely, with mimesis, we see a competitor adopting a technology and decide to do so as well simply to “keep up with the Jones” without assessing the fundamentals.

These factors drive social movements and countermovements focused technologies across sectors, including the recent debates on AI existentialism vs. accelerationism (2024, McCord).

Phases of Nuclear Energy Beliefs

- First Faith Phase (1950s - 1960s): Following World War II, nuclear energy was heralded as a revolutionary and futuristic technology. It was considered a solution to the growing energy demands, promising a clean and abundant source of power. This period saw significant investment and enthusiasm in developing nuclear power plants around the world.

- First Fear Phase (1970s - 1980s): Public perception shifted dramatically following incidents like the Three Mile Island accident in 1979 and the Chernobyl disaster in 1986. These events heightened fears about the safety and environmental risks of nuclear power, leading to protests, increased regulation, and a slowdown in new plant constructions.

- Second Faith Phase (1990s - 2000s): During this period, there was a gradual resurgence of interest in nuclear energy, driven by concerns over fossil fuels and greenhouse gas emissions. The industry focused on promoting the safety and environmental benefits of nuclear power, leading to some renewed support and investment, particularly in countries like France and Japan.

- Second Fear Phase (2011 - 2023): The Fukushima Daiichi nuclear disaster in 2011 reignited global fears about nuclear safety. This event, caused by a massive earthquake and tsunami, led to significant public and governmental backlash against nuclear power, with several countries scaling back or phasing out their nuclear programs.

- Third Faith Phase (2023 - Present): In the context of climate change and the urgent need for carbon-neutral energy sources, there is a renewed interest in nuclear energy. Advances in technology (GenIV systems) and improvements in safety and waste management are contributing to the growing optimism about nuclear power's role in a sustainable energy future.

Red Flags & Green Flags

Equipped with The Triad, we are now going to provide a normative analysis of when it makes sense to invest in technologies. To achieve this, we can visually explore the space of potential outcomes as shown below in terms of maximum and minimum potential output from a technology based on the dimensions + pendulums we laid previously:

Good investors deploy capital when a technology is near the minimum output with signals that pendulums will swing towards the maximum in the near future in a manner that will allow value capture by a given company. The specific opportunities for investment occur when we recognize the fallibility of others. This means that other participants have a negative view along a given dimension (scarce, divergent, fearful) where we are positive (abundant, convergent, faithful). With this in mind, several red flags and green flags for investing emerge that are applicable across sectors.

Red Flags: When Not to Invest

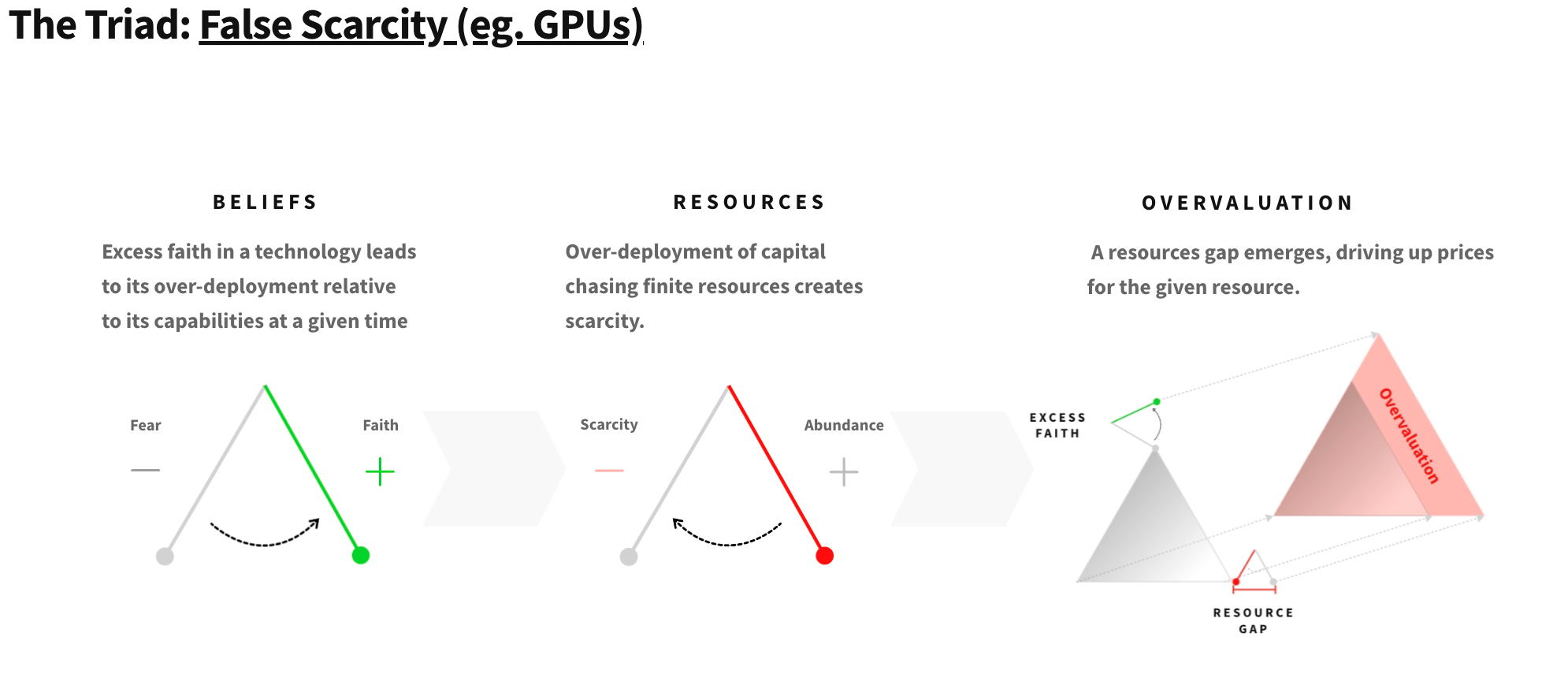

False Scarcity

Definition → The over-deployment of capital chasing finite resources leads to high prices that are often unjustified based on true demand. This can be modeled as the resource pendulum being pushed from abundance to scarcity prematurely.

Areas to Watch in 2024→ GPUs, Blockspace, Uranium

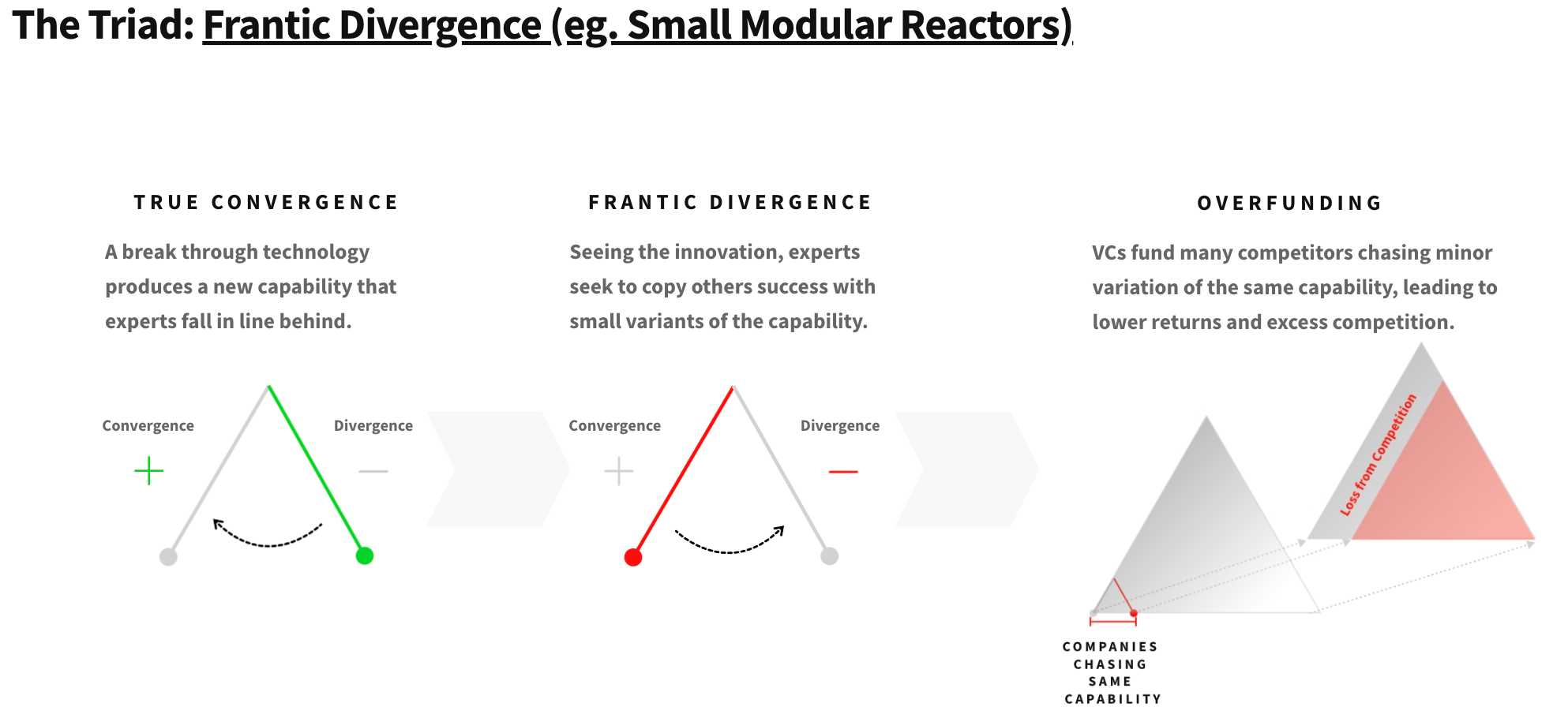

Frantic Divergence

Definition → Following convergence around a new capability, participants see what works and copy it with small modifications to attempt to capture market share. This can be modeled as the capability pendulum swinging from convergence to divergence prematurely. We believe this is a red flag that many generalist VCs succumb to, following others into investing in technologies without a fundamental understanding of it.

Areas to Watch in 2024→ LLM for X, GPT for Y, Small Modular Reactor but Z

The Plumber Problem

Definition → Over exuberance leads to “everyone” having opinions that ultimately are not based on fundamentals. This can be modeled as excess faith in a market or technology. This typically occurs during bubbles.

Green Flags: When to Invest

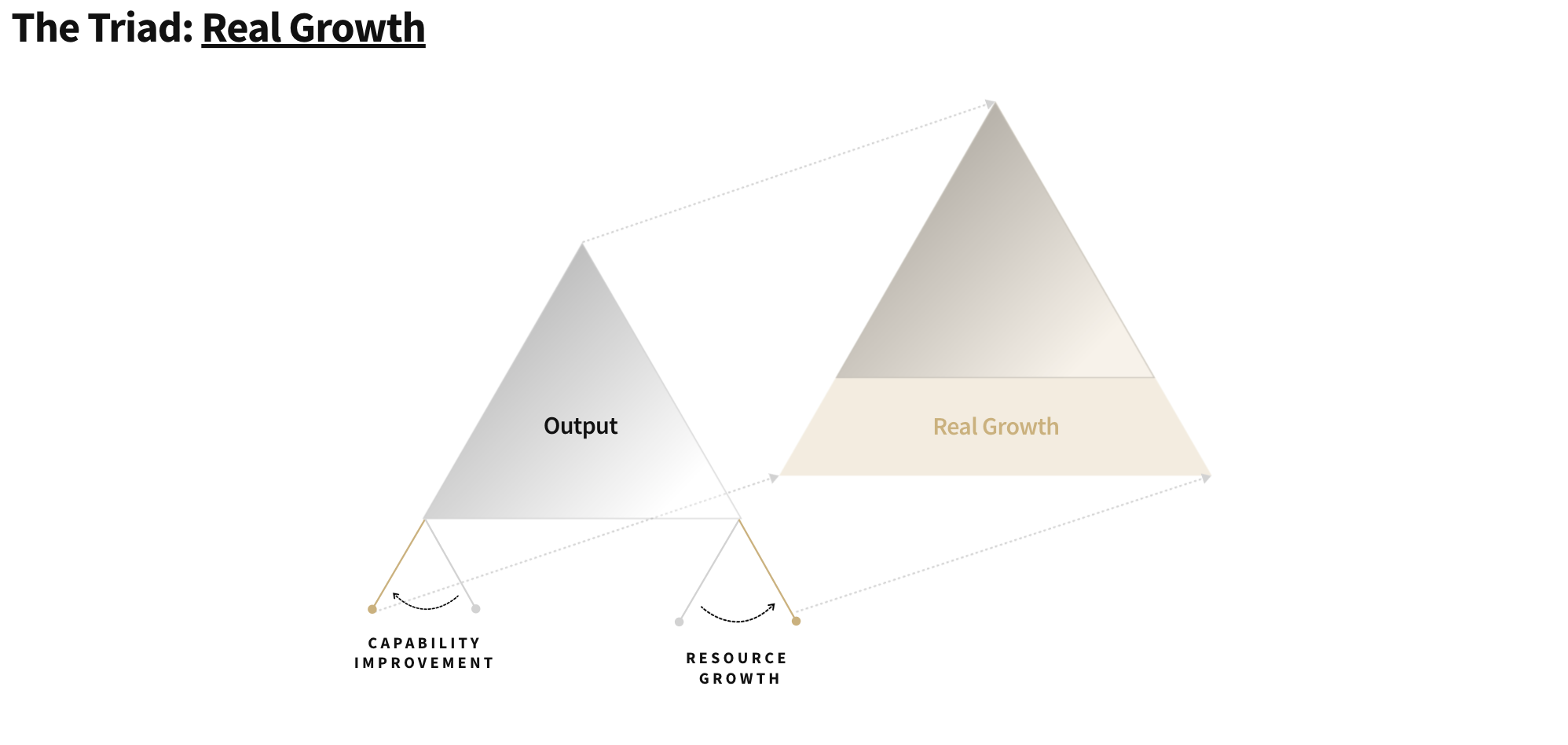

Green flags occur at the transitions to periods of real growth driven by convergent capabilities or resource abundance, as shown below:

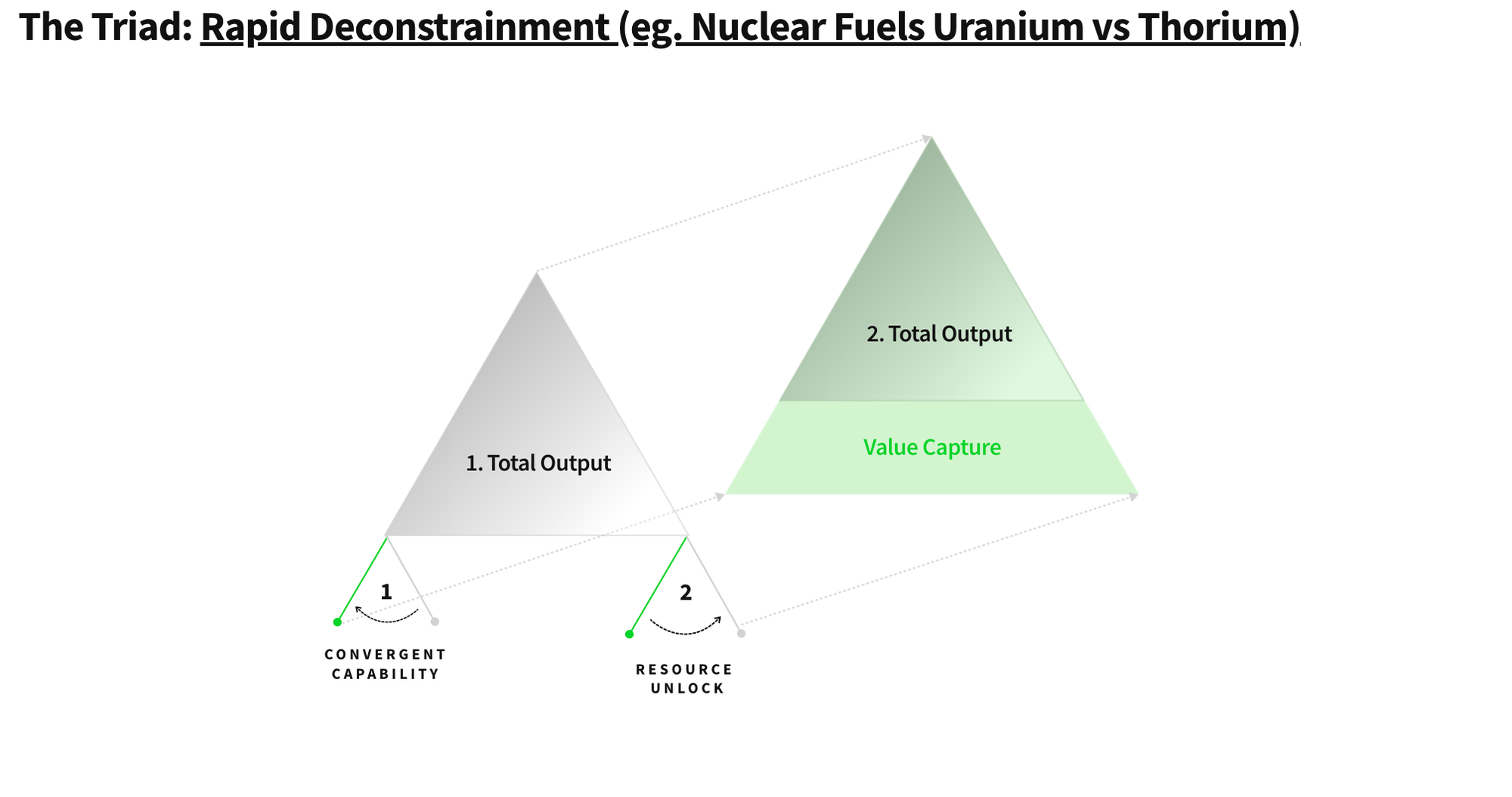

Rapid Deconstrainment

Definition → This occurs when a previously scarce resource either becomes abundant (due to new supply) or an alternative is found.

Areas to Watch in 2024→ We believe we are about to see such a development in nuclear with thorium as an alternative to uranium. Presently, uranium resources are becoming scarce, with countries like China cornering the market. New capabilities (like Transmutex) have the potential to rapidly deconstrain this.

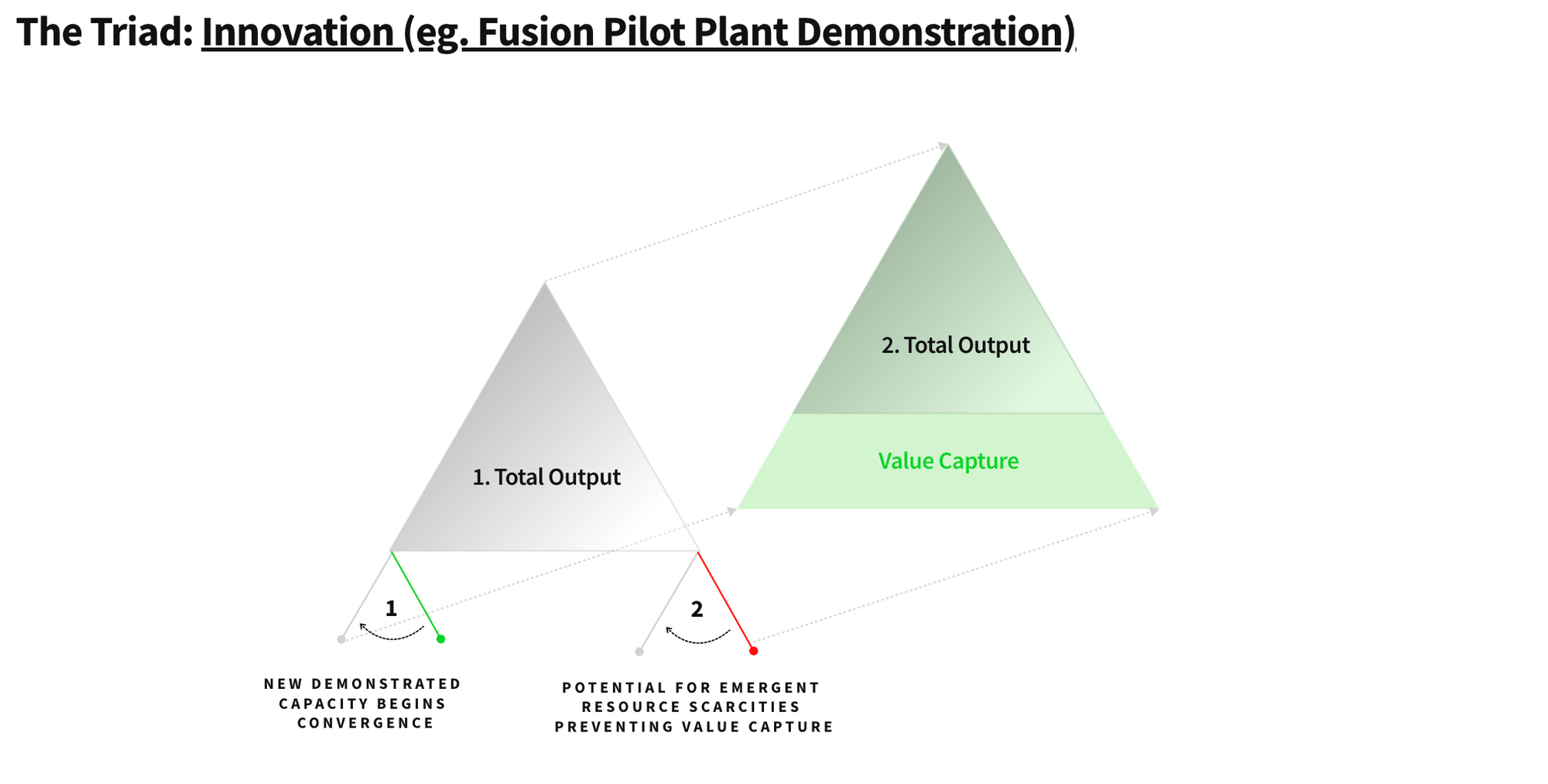

Innovation

Definition → This occurs when a new capacity emerges that begins to drive convergence within a domain.

Area to Watch (~2026)→ We believe it is too early to invest in specific fusion reactor designs (if the bet is that it becomes dominant) as a generalist fund because the transition to a convergent phase has not occurred yet. There are still too many credible designs (tokamaks, stellarators, inertial systems, etc.) that different experts believe in. We believe we will have to wait until we see pilot demonstrations in 2026 and beyond for this moment to come.

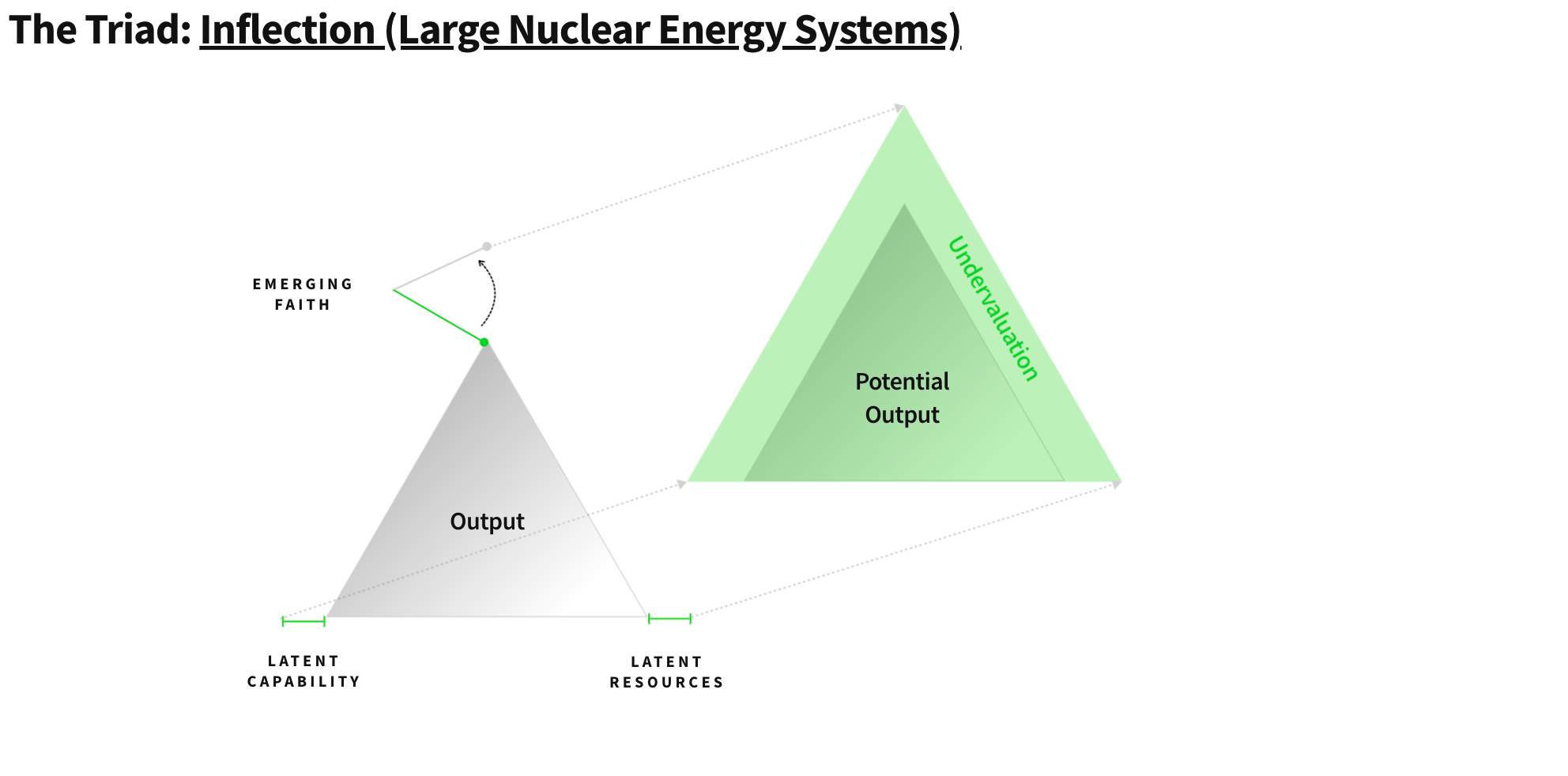

Inflection

Definition → This occurs when movements become counter-movements and vice versa, often after a scapegoating. This shift in beliefs is frequently followed by the rapid adoption of certain technologies due to a willingness to adopt products (regardless of their fundamentals). This can be modeled as the moment the belief pendulum moves from increasing fear to increasing faith.

Areas to Watch 2024→ We witnessed this play out at hyper speed in 2023 with the scapegoating of Sam Altman at OpenAI due to the perceived existential risks of AI. Outcry from employees quickly led to him to being reinstated with renewed vigor and faith in their approach. We believe that we just crossed one of these inflection points in nuclear with 22 nations committing to triple nuclear energy output at COP28 and will see growing faith from here on out, especially in large format nuclear systems.

Closing Thoughts

The Triad is a work in progress. We are sharing it anyway for three reasons:

- The Triad helps explain our conviction leading Transmutex for a Series A relative to our other investments (all of all which align with our Resilience Matrix). Put another way, The Triad drove our sizing, whereas the Resilience Matrix drove our selection.

- The Triad gives us a structure for identifying both where we are likely to find the biggest opportunities in the future, and how to avoid succumbing to the inevitable hype cycles that occur in venture, cannibalizing returns.

- Ultimately, the purpose of these memos is to share our ideas with a small set of insiders we respect to both refine our thinking via feedback and to more easily work together via shared context.

Although it is far too bold to claim that The Triad is predictive of large-scale technological adoption, we feel it provides a technique for describing the “shape” of these trends at any moment. This allows us to take a snapshot of our beliefs + predictions in a manner that enables structured retroactive analysis on where the path that unfolded deviates from expectations. With it, we lay the foundation for learning.

This memo is the first in a series that we will be sharing over the coming years. The Triad will serve as a jumping off point for an analysis of the most important technologies to invest in. We intend for our investments in these technologies in the decades to come to build a more resilient and balanced future for all:

- (Part 1) The Triad: Our Framework for Investing → this memo outlining the purpose, origins, and application of The Triad.

- (Part 2) [Case Study] The Future of Civilian Nuclear → using The Triad to analyze why we see opportunities in civilian nuclear energy systems stemming from new-found belief (international commitments to nuclear), new resources (thorium), and new capabilities (GenIV reactors).

- (Part 2) The Big Three & Beyond → we widen our aperture to assess three technological domains that will shape our world; energy, intelligence, and decentralization. We will explore how The Triad can be used to understand how technologies in these domains will be deployed and adopted to address of the most critical challenges of the day; climate change, education, and healthspan. Finally, we will apply this method of analysis to deployment of resilience enabling industrial technologies.

- (Part 4) The Third Way → we dive into why the mitigation of volatility through investments in resilience enabling technologies aligns with our vision of a better world. We will then look at how the technologies we covered in previous sections can work in harmony to promote individual and collective flourishing.

Footnotes

- This pattern of convergence and divergence can also be seen in everything from microprocessor architectures, open source frameworks, to mobile device design and OSs. It is worth noting that the convergent phase can be driven by both “function” and mimesis. iPhones were a better product but they also became a status symbol, driving adoption and convergence. As technology has permeated in culture, this mimetic nature has led to it becoming fashion (eg. “luxury” email products like Superhuman).

- Other interesting resources worth looking into included GPUs / machine learning engineers and nuclear fuels. It is also interesting to reflect on how business models can “unlock” resources, for example Uber created new “taxi” supply and AirBnB new “hotel” rooms.

- Reach out for our memo on potassium battery chemistries here.

- See our memo on venture opportunities in vanadium here.

This can be attributed to The Precautionary Principle. The Precautionary Principle is a strategy for approaching issues of potential harm when extensive scientific knowledge is lacking. The principle is often applied in the context of environmental health and safety, where it advocates for preventive action in the face of uncertainty, shifting the burden of proof to the proponents of an activity. Rather than waiting for scientific certainty about the risk, the principle suggests that it's better to take precautionary measures if there is a suspected risk of harm to the public or to the environment.