The next AI frontier in industrials won’t be software-first startups — it’ll be service providers using workflow access to build software moats. These firms will gather tribal knowledge via service delivery, codify it through internal tools, and monetize it through recurring software layers. The real advantage is in layering software onto these workflows to institutionalize that data advantage. The unlock is in pairing:

- Services to gather workflow data

- Internal software/AI to codify it

- Recurring tools to monetize it

This is how you build digital moats in analog worlds. The service builds the distribution, the software builds the margin, and the data builds the moat.

Industrial services represent over $40B in annual spend, yet they remain one of the least digitized, least automated sectors in the world. While AI has transformed white-collar workflows and reshaped digital customer support, the industrial world still runs on handshakes, paper, and expertise trapped in heads, not code. Software utilization is painstakingly low.

The most successful industrial tech service firms will be Trojan horses. They will sell low-margin services to gain customers and data, but transition to selling high-margin software built on that data. When I invested in Palantir in 2019, they were a services business embedding engineers in workflows to make historically siloed data useful. Over time, they replaced those same engineers with sticky software sold back to those same customers. Today, they’re a ~$200B company with 80% margins on recurring revenue. This is the blueprint.

Not all services are created equal

Services exist to arbitrage transaction costs (Ronald Coase, 1937). When it’s cheaper to outsource a job than manage it internally, firms contract out. Comparative advantage reinforces this: nobody can be world-class at every step in a complex value chain.

Historically, many SaaS businesses tried to tackle the vast services market by selling software into services firms. We have witnessed that these firms in industrials are unwilling to adopt software themselves. However, now that AI can match or outperform humans in repeatable tasks (even with small example sets), it breaks this pattern. If the job is repeatable, high-value, and time-sensitive (compliance audits, equipment inspection, contract review), then an AI-enabled service provider with internal proprietary tooling can win by being faster, cheaper, and eventually better than slower human-led incumbents.

Emergence Capital did a great job mapping high repeatability vs. "do it for you” opportunities in traditional services. We’ve created our own version below applied to industrials.You can see obvious targets like QA/QC, oil and gas well log interpretation, and geotechnical engineering soil tests.

P&L’s in industrials show line items for services to outsource tasks, but not software to invest and utilize. What we are seeing is a large shift across all services. Services today are conducted via knowledge work labor (opex), but what we will see is a slow shift of those services into agentic AI workflows and interfaces (capex).

Moving opex to capex is one of the universal patterns in technology. Mass manufacturing achieved this by standardizing worker output and complimenting it with industrial machinery. Agentic systems are just the latest incarnation applied to knowledge work.

The smart services firm will use the services as a sensor (a la Data Gushers) to capture data on workflows, then productize the most repeatable, high value workflows into software. By revealing which workflows are most ripe for automation and embedding themselves within day-to-day operations, service providers gain privileged access to edge cases, exceptions, and latent coordination patterns. Think of a Palantir Forward Deployed Engineer.

As agent frameworks become more capable through few-shot and zero-shot learning, they no longer require vast training sets to act reliably. Techniques like Google’s “teach and repeat,” showcased with Project Mariner, demonstrated how agents can internalize generalized task structures from minimal exposure. Contrary recently released a great breakdown of just how these agents will automate entire business units.

Source: TeckNexus

But as access to base models becomes commoditized, defensibility shifts toward proprietary workflow data and reputational trust – areas where services operating in narrow, high-context domains can build differentiated moats.

The O-Ring Premium

In 1986, the NASA Challenger shuttle disaster was caused by a cheap rubber “O-Ring” failing; the whole $1 billion system disintegrated because of that single point of failure. When tasks are tightly coupled, the weakest link sets the payoff. High-stakes, high-complexity economies therefore hinge on flawless execution at every node. Poor execution at the smallest of places, runs the risk of destroying the entire product.

As services firms scale, they begin to add more and more to their toolbox of ‘do-it-for-you’ options. Gathering enough mass of services, these firms will command an O-Ring Premium. An O-Ring premium is the valuation bump a firm earns when every link in its production chain approaches fault-free execution. In a multiplicative system, boosting each task’s success rate from 95% to 99% doesn’t just add four points of yield, it compounds across dozens of steps, often doubling effective output and slashing tail-risk to near zero.

We are investing in companies that capture the O-Ring premium:

- Scale economics in knowledge. A leading services firm compounds tacit know-how (process playbooks, benchmark data) and can redeploy that knowledge at near-zero marginal cost, even if its gross margin looks lower than pure SaaS. Fictiv’s ability to automatically quote 4M+ parts across 250+ manufacturers is a demonstration of this principle in action.

- Sticky workflows. Once a service is woven into a customer’s daily operations, switching costs rival software — often higher because people and relationships are embedded (sometimes even hardwired).

- Data network effects. Modern tech-enabled services firms archive the transactions they mediate, using that proprietary data to automate more of the workflow and widen their moat.

Why This Model Scales

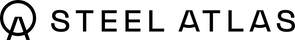

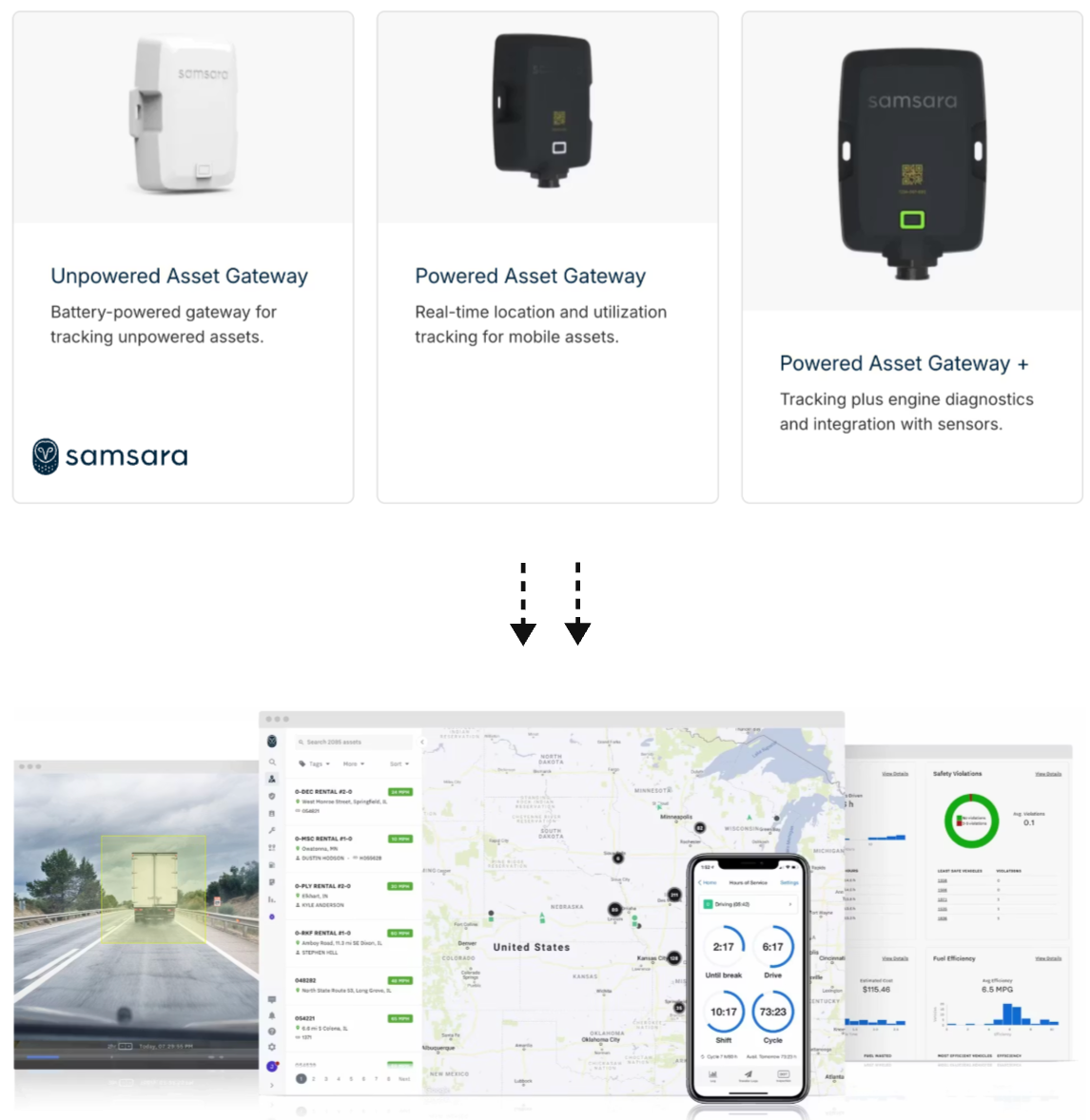

Those three make it perfect for a services firm to eventually build out software to replace itself (while being paid for it). The counter to this is well articulated by Charles Rubenfeld’s essay, stating that the margins are too slim to be both a services provider and to build software products at the same time. That’s exactly how Samsara ($20B market cap) evolved: installing IoT sensors as a service for fleet management, then building an AI layer on top that now sells modules for safety, compliance, and fuel efficiency. These are all fed by a constant stream of 50 billion sensor-minutes per day.

However, if we consider services a means-to-an-end to produce valuable, sticky software in these markets, then it is worth spending venture capital to get there (and often the ability to raise large amounts of capital for this can be a moat in and of itself). Margins of services businesses are slim given the manual nature of delivery, so venture dollars are needed to fund the software-product team that is codifying workflows. We perceive the initial services arm of the business as a positive CAC for the ultimate and highly-scalable software distribution strategy.

This is especially true in areas without great off-the-shelf software or historically low software utilization for structural reasons:

E.g. UpKeep (mobile-first CMMS for facilities and maintenance teams) → Industrial maintenance & inspections are still mostly clipboard-based, high travel-to-work ratios.

E.g. Strike Graph (automates SOC 2 and other compliance prep) → Regulatory filings and audit prep have a high compliance burden, low standardization across firms, and often outsourced to manual systems.

Inherent Moats

Our portfolio company Hedral is tackling jobs in engineering and architectural design. They have a team of engineers that delivers their core 'product' of drawings and other related outputs, then a software team divided into product, AI, and general software roles. The delivery team pulls from their daily work to define scope for the product team, who then activates the rest of the org to automate. That software then makes the engineering team far more efficient, creating lift and boosting unit economics on a per-workflow basis. A growing dataset of design decisionmaking and respective 'consequences' per job serves as a large part of Hedral's moat.

There are several moats that exist in this manner of building a software business:

- Temporal moats → agentic workflows improve with time-on-task

- Behavioral moats → software that reflects domain-specific intuition

- Reputational moats → in high-risk, do-it-for-you environments, trust compounds

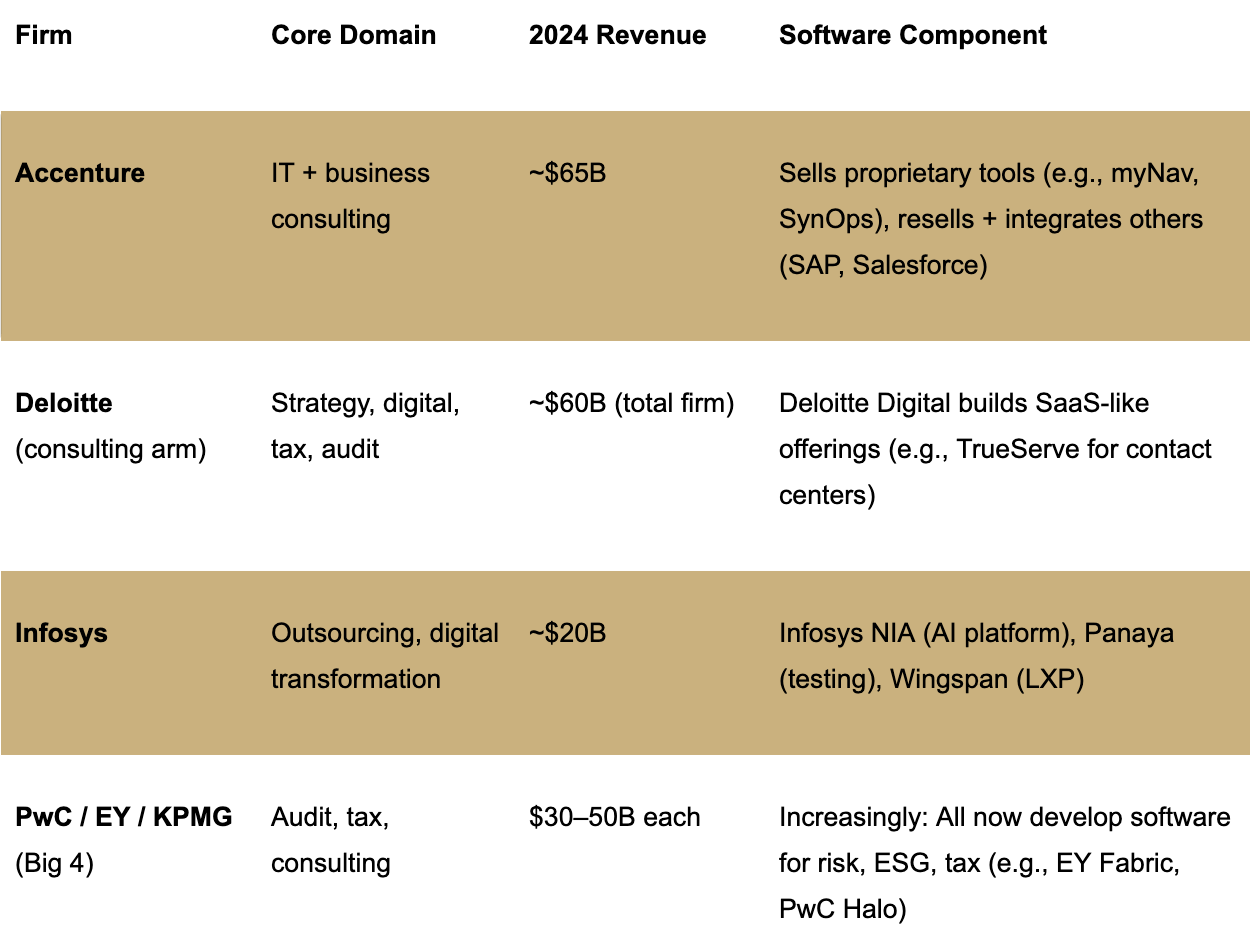

The service remains the initial pull, but this hybrid model is what rakes in the highest quality revenue. The most optimal grouping of services allows you to bundle sets of services efficiently that, once automated, look more like a platform. Think of the massive EPC market with Bechtel, Fluor, and Kiewet. Engineering, procurement, and construction altogether are far more valuable than the individual services as stand-alone products. The same can be said for the incumbent hybrid service/software firms. Many of these consulting businesses are layering platforms + IP software atop consulting to drive margins, stickiness, and data moats. Internal tools like Accenture’s myWizard, Infosys’s NIA, or Deloitte’s Greenhouse started as productivity enhancers but now sell externally or shape engagements.

Identifying the right opportunity

Most tech-enabled services fail not because the wedge is wrong but because the transition path is undefined. Moving from manual services execution to a software-driven model requires more than ambition. It demands a clear operational roadmap, measurable milestones, and a business model that compounds over time.

Investors should look for signs that the company can abstract repetitive workflows into code, capture and reuse data to improve performance, and build toward a system where each engagement reduces marginal cost. This section offers a structured way to assess whether a service business has the DNA to evolve into a scalable software platform.

- Demand a Transition Map → Ask founders to outline a clear quarter-by-quarter roadmap showing how manual service components are gradually abstracted into software. This plan should indicate specific inflection points where automation begins to replace labor and drive margin expansion.Ideally we want to see product managers tightly coupled with service delivery teams.

This is to refine the feedback loop between engineering and ops for workflow discovery and agentic buildout. The service delivery should be built as a structured data generation pipeline to develop the tools, not just fulfillment. - Model Two P&Ls → Construct two profit-and-loss statements: one representing the current state (labor-heavy, low-margin services) and another X years out (software-first, margin-rich platform).

Over time, opex tied to headcount should decouple from revenue growth, and you should see fixed costs (product, infra) scale more efficiently than variable ones (delivery). Watch for rising revenue per employee, declining cost per workflow, and early signs that software is being sold into net-new customers who never used the service. - Underwrite Data Rights → Confirm that the company has contractual rights to reuse operational data, including logs, annotations, and derived insights.

As AI continues to collapse the cost of cognition, the line between service and software will blur. The companies that win will not be the ones with the cleanest codebase, but the ones with the deepest operational insight — and the rights to the data that encodes it. If services are the new sensors, and workflows the new IP, then the next great question is defined by what happens when your margin is not a feature of your software, but a function of how well you’ve understood the job?

We’re looking for founders who are tackling industrial services that are nowhere near ready for the advent of AI, agents, and machine learning, to eventually turn these services into scalable and moat-generating software products. We believe the next generation of Bechtel, AECOM, or Worley will appear within the next few years. If you know anyone building in this space, reach out.